Simplivity Not Selling Itself To HP – Or Anyone Else

Rumors have been going around this week that Simplivity, one of the converged systems upstarts that is heavily funded and trying to take on the incumbents in enterprise datacenters, is in talks to be acquired by Hewlett-Packard. This is not going to happen, the company tells EnterpriseTech.

The rumors first surfaced at <i>CRN</i>, which cited multiple sources claiming there were talks ongoing between HP and Simplivity. At the time, both HP and Simplivity declined to comment on rumors and speculation, as is common with such chatter, but then Doran Kempel, chairman and chief executive officer at Simplivity, was talking to us about hyper-converged systems and took the opportunity to step on the chatter about a potential buyout.

"The rumor about HP acquiring Simplivity is false," says Kempel. "HP is not acquiring Simplivity for $2 billion, which is the rumor as it was posed to me late last night. In fact, we are not in dialog with HP about acquisitions, nor are we in dialog with HP about any other commercial relationships, nor are we in dialog with another party about acquisitions or relationships, nor have we thus fat been in dialog with any party regarding acquisitions. I think I have covered all of the dimensions of that rumor, so if you are a customer or a partner, you can rest assured that we are focused on our customers, and growth, and we have our hands full."

That is not to say that Simplivity would not be an attractive target for an acquisition by any of the incumbent server makers looking for a more lucrative sales proposition. They all need to compete against Cisco Systems, which started the convergence move five years ago with its UCS systems, which brought servers and switches together under a single management framework with VMware server virtualization on top. Simplivity is also competing against Nutanix, Scale Computing, and Pivot3, which have gone further than Cisco by converging storage into the system and providing shared storage across the nodes in a cluster.

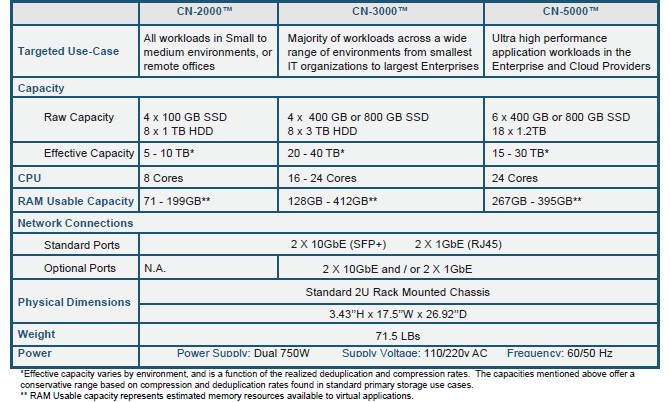

Simplivity's OmniCube converged systems have gone even further, says Kempel, bringing together servers, storage, networking, and a slew of WAN optimization, backup, recovery, and data tiering software into a single appliance that can be scaled out for performance. Here is how Simplivity stacks itself up against the competition:

The OmniCube appliance starts with something that is very familiar to datacenters: a two-socket server based on Intel's "Ivy Bridge" Xeon E5 v2 processors. To this, Simplivity adds a card with a field programmable gate array (FPGA) that has been equipped with de-duplication and compression algorithms as well as data management code to absolutely limit the amount of storage needed in the system. This FPGA accelerator de-dupes and compresses data as it is being ingested in the system, one time, and then stores it on flash or disk storage as the relative temperature of the data requires. The basic premise of the design, explains Kempel, is that I/O operations are very expensive and you want to absolutely limit them at all levels in the system.

There are two other key tenets of the OmniCube design. One is that appliances have to be linked together to share data so administrators working from the datacenter can get a single view of local machines as well as those in remote offices or other datacenters. The idea is to create one pool of virtualization for workloads and manage it all from a single screen. The file system at the heart of the OmniCube does not have a name, but it is homegrown and stores data in 4K blocks that are tuned specifically for server virtualization hypervisors. At the moment, the OmniCube stack supports VMware's ESXi hypervisor and its management interfaces plug into the vCenter console. But Kempel tells EnterpriseTech that support for Microsoft's Hyper-V and System Center combination as well as the open source KVM hypervisor and its OpenStack cloud controller companion are in the works. Kempel says Simplivity expected for more demand for Hyper-V, but that the enterprises his company is talking to are asking for the KVM/OpenStack combination more loudly these days. The company has not made a commitment to rolling out support for either as yet, but will soon.

The other thing that Simplivity tackled with its OmniCube software stack is the plethora of somewhat redundant but necessary appliances and software programs that companies have to deploy to manage their data within a cluster of systems and across datacenters. The legacy stack has servers running VMware hypervisors, data protection applications, a switch for linking nodes together and another switch (often based on Fibre Channel) for shared primary storage. Then companies often have a flash array to accelerate certain applications, and another cache for storage to speed that up. Then there are backup appliances, WAN optimization appliances to link to remote sites, and cloud gateways to link to remote clouds. Add it all up and there are a dozen or so separate programs that are involved, and these cost money to acquire and require administrators to use. By shifting to an appliance that does all of these jobs, Simplivity says that it can cut both the capital expenses and operating expenses associated with all this infrastructure by a factor of 3X.

Here are the feeds and speeds of the current OmniCube appliances:

The midrange CN-3000 costs about $65,000 per node, not including a license to VMware's ESXi hypervisor or vCenter console for managing VMs on the cluster. Kempel says this price includes a machine with 768 GB of usable memory, more than shown on the table above. The top-end CN-5000 machine costs about $80,000 fully loaded (again, with more memory than shown in the table above). These are not inexpensive server nodes by any measure. But all of those other appliances and software licenses used in a legacy infrastructure stack are not cheap, either, and the operational savings in terms of power, space, maintenance, and management personnel add up as well.

Simplivity has some pretty big backers, including Accel Partners, Charles River Ventures, and Kleiner Perkins as initial investors back in early 2012 and with Swisscom Ventures, Meritech Capital Partners, and DFJ Growth added in a third round of financing last November. To date, the company has raised $101.5 million and that last round was a whopping $58 million to really ramp up the business. The company has sold to hundreds of customers thus far and Kempel says that the investors in the company have not seen a ramp like this one in a long time and are "happy with the company's progress."

In general, converged systems are outpacing the server market overall, which is flat in terms of revenues and nearly flat in terms of shipments. Which again brings up the topic of Simplivity being acquired, and such talk will not go away, no matter how many times Kempel steps on it.