Dell Technologies Delivers 2nd Quarter Fiscal 2024 Financial Results

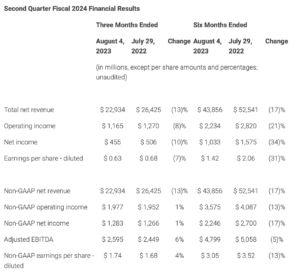

ROUND ROCK, Texas, Sept. 1, 2023 -- Dell Technologies (NYSE: DELL) announced financial results for its fiscal 2024 second quarter. Revenue was $22.9 billion, down 13% year-over-year and up 10% sequentially. The company generated operating income of $1.2 billion and non-GAAP operating income of $2 billion, down 8% and up 1% year-over-year, respectively. Diluted earnings per share was $0.63, and non-GAAP diluted earnings per share was $1.74, down 7% and up 4% year-over-year, respectively. Cash flow from operations for the second quarter was $3.2 billion, driven by working capital improvements, sequential growth and profitability. The company has generated $8.1 billion of cash flow from operations throughout the last 12 months.

Dell ended the quarter with remaining performance obligations of $39 billion, recurring revenue of $5.6 billion, up 8% year-over-year, and deferred revenue of $30.3 billion, up 8% year-over-year, primarily due to increases in service and software maintenance agreements. Cash and investments were $9.9 billion, and the company returned $525 million to shareholders in the second quarter through share repurchases and dividends.

Dell ended the quarter with remaining performance obligations of $39 billion, recurring revenue of $5.6 billion, up 8% year-over-year, and deferred revenue of $30.3 billion, up 8% year-over-year, primarily due to increases in service and software maintenance agreements. Cash and investments were $9.9 billion, and the company returned $525 million to shareholders in the second quarter through share repurchases and dividends.

“Our Q2 performance underscores the power of our model to generate cash in a sequential growth environment,” said Yvonne McGill, chief financial officer, Dell Technologies. “Revenue grew 10% sequentially to $22.9 billion, with strong cash flow from operations of $3.2 billion in Q2 and $8.1 billion over the last 12 months. We continue to deliver value to shareholders and have flexibility to increase our return of capital going forward.”

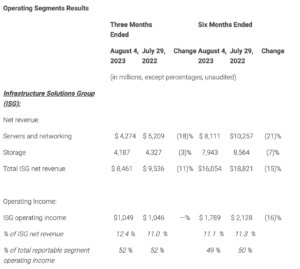

Infrastructure Solutions Group delivered second quarter revenue of $8.5 billion, down 11% year-over-year and up 11% sequentially. Storage revenue was $4.2 billion, with continued demand growth in PowerStore, the company’s leading midrange storage array, and PowerFlex, the company’s software-defined storage. PowerFlex has now grown eight consecutive quarters with second quarter demand more than doubling year-over-year. Servers and networking revenue was $4.3 billion, with continued demand growth in AI-optimized servers. Operating income was $1 billion, approximately 12.4% of Infrastructure Solutions Group revenue.

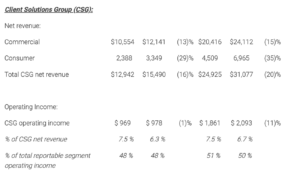

Client Solutions Group delivered second quarter revenue of $12.9 billion, down 16% year-over-year and up 8% sequentially. Commercial client revenue was $10.6 billion, with demand growth in workstations, which help organizations run complex AI workloads locally. Consumer revenue was $2.4 billion. Operating income was $969 million, or approximately 7.5% of Client Solutions Group revenue.

“With a better demand environment and strong execution, we delivered extraordinary Q2 results,” said Jeff Clarke, vice chairman and chief operating officer, Dell Technologies. “We continue to focus on the most profitable segments of the market where we have a leading position. Demand for our proprietary software-defined storage solution has now grown eight consecutive quarters. Our client solutions group business was up 8% sequentially with strong attach rates. And AI is already showing it’s a long-term tailwind, with continued demand growth across our portfolio.”

Dell expanded on its May announcement of Project Helix and introduced Dell Generative AI Solutions, which spans IT infrastructure, PCs and professional services to simplify the adoption of full-stack generative AI with large language models on premises.

- The Dell Validated Design for Generative AI with NVIDIA is an inferencing blueprint, jointly engineered with NVIDIA, that helps customers generate higher quality, faster time-to-value predictions and decisions with their own data.

- Dell PowerEdge XE9680 servers are optimized for generative AI applications and are the fastest ramping new solution in Dell history.

- Dell Precision workstations run AI software frameworks 80% faster than the previous generation and have up to four NVIDIA RTX 6000 Ada Generation GPUs.

- Dell Professional Services help customers accelerate generative AI adoption and improve operational efficiency.

Conference Call Information

As previously announced, the company will hold a conference call to discuss its performance and financial guidance on Aug. 31 at 3:30 p.m. CDT. Prior to the start of the conference call, prepared remarks and a presentation containing additional financial and operating information prior to financial guidance may be downloaded from investors.delltechnologies.com. The conference call will be broadcast live over the internet and can be accessed at https://investors.delltechnologies.com/news-events/upcoming-events.

For those unable to listen to the live broadcast, the final remarks and presentation with financial guidance will be available following the broadcast, and an archived version will be available at the same location for one year.

Environmental, Social and Governance (ESG)

Our Environmental, Social and Governance (ESG) efforts focus on driving positive impact for people and our planet while delivering long-term value for our stakeholders. ESG resources can be accessed at https://www.dell.com/en-us/dt/corporate/social-impact/reporting/esg-governance.htm.

About Dell Technologies

Dell Technologies (NYSE:DELL) helps organizations and individuals build their digital future and transform how they work, live and play. The company provides customers with the industry’s broadest and most innovative technology and services portfolio for the data era.

Source: Dell Technologies