Intersect360: ‘Grand Unification’ Spending Totals $251.9B in 2022

The folks at Intersect360 Research released their latest report and market update just ahead of ISC 2023, which was held in Hamburg, Germany, last week. The headline: “We’re returning to stable growth,” per Addison Snell, Intersect360 CEO.

In the “grand unification” view of the market – which includes Intersect360’s analysis of both on-prem and hyperscale datacenters – total spending was $251.9 billion in 2022, representing 7.2% growth year-over-year. Of that, $30.4 billion (~12%) was for on-prem HPC and AI systems ($28.8 billion of that specifically to HPC budgets); $95.4 billion (~38%) was for on-prem enterprises systems; and just over 50% was for hyperscale, which – for the first time, per Intersect360 – represents more than half of datacenter spending.

“That’s 9.7% growth year-over-year from 2021, but that is slowing,” Snell said. “This had been over a 25% compound annual growth rate in hyperscale over the previous five years, and we saw – particularly in the second half of 2022 – that really tailing off, and you saw some of the hyperscale companies themselves starting to react to the reduction in growth rate with layoffs or slows in growth across hyperscale.”

This segued to a running theme in the presentation: cloud’s meteoric rise continued in 2022, but the Intersect360 team believes that the atmosphere is getting too thin for that rise to continue. Snell explained that cloud had boomed during the pandemic, but that “2023 should really be the final year of the double-digit growth for cloud in HPC/AI. It’s had eight straight years of double-digit growth.” Intersect360 believes that cloud should peak at about 15% of traditional HPC spending, or 23% of the combined HPC/AI market.

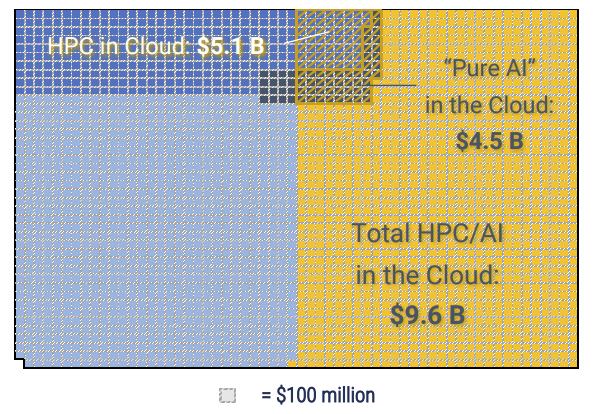

Speaking of cloud, this was the second year that Intersect360 tracked “pure AI” as its own spending category – this year, it’s at $1.6 billion. The cloud part comes in because Intersect360’s report shows that “pure AI” is represented more heavily in the hyperscale market (which is not covered in most of the numbers discussed in this article) than traditional HPC: include the cloud numbers, and HPC spending goes up by $5.1 billion (+17%) to $33.9 billion; pure AI, meanwhile, goes up by $4.5 billion (+281%) to $6.1 billion. That said, Snell hedged that on-prem deployments of AI hardware were increasing: “It’s not strictly a cloud market any more.”

The overall area is total datacenter spending in 2022. Medium blue represents HPC spending; dark blue represents AI spending. The orange slashes represent the areas of those markets managed by hyperscalers. Image courtesy of Intersect360.

Moving back to the non-hyperscale analysis of the HPC/AI markets: Snell said that the market was “back into a stable growth mode” for 2022 following the “deleterious” effects of the Covid pandemic in 2020 and 2021. (“We really lost two years of growth,” he said.)

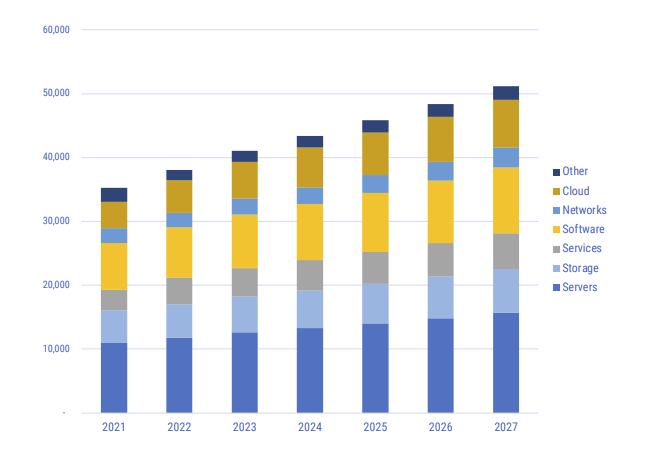

But now, the aforementioned stable growth. The traditional HPC market grew 8.1% year-over-year to $38.1 billion; the combined HPC/AI market grew 11.3% year-over-year to $44.4 billion. Servers were the largest component of the traditional HPC spending and grew by 7.5%, but the fastest-growing segments were the services and cloud segments (+29.5% and +25.3%, respectively); these trends held true in the expanded HPC/AI view.

Looking ahead to the next five years – 2023 to 2027 – Intersect360 is projecting a 6.1% compound annual growth rate (CAGR) for the traditional HPC market, hitting $51.2 billion by the end of those five years. With the AI market in the mix, that goes up to a 6.3% CAGR, hitting $60.4 billion. (Again, as Snell cautioned throughout the briefing, all of this excludes hyperscale spending.)

Intersect360’s forecast for the traditional HPC market (products and services) in millions of dollars.

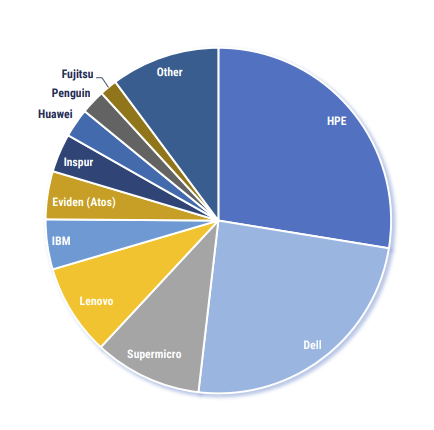

In terms of vendor trends: HPE and Dell again had strong showings as the dominant forces in the HPC vendor space, growing at what Snell described as market rates. Supermicro overtook Lenovo to become the third-place vendor, and IBM showed surprisingly strong growth from its Z Series systems. Further, Snell said that while they were not yet tracking Nvidia as a vendor, “we’re confident saying that if we put them on the chart, they would be the number-five vendor with about $700-800 million in sales.”

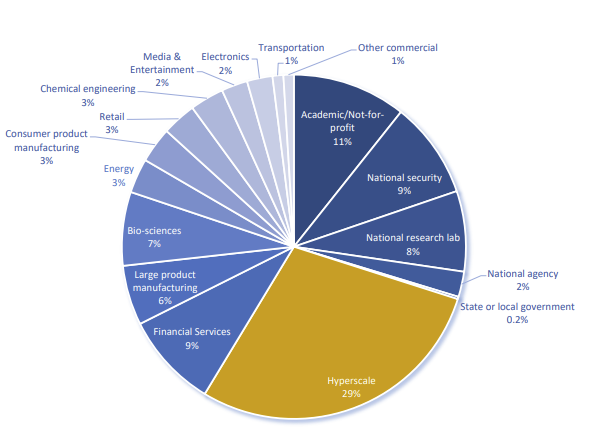

In the vertical markets, Snell said, there was “not a lot of change.” The biggest growth was seen in the manufacturing and energy segments, which were “some of the bigger affected ones” in terms of pandemic fallout. Just for fun, Snell added “hyperscale” as a vertical in one graph, where – at 29% of the market – it dwarfed the competition. Intersect360 expects that the government sector will lead growth over the next five years.

Following a couple of years led by the Asia-Pacific market, Intersect360 saw that flip around this year, with North America and EMEA leading spending at +12.8% and +11.9%, respectively. “EMEA is really going to lead the growth over the next five years,” Snell projected.

To learn more about Intersect360’s market analysis, click here.