SambaNova Adds GPT Banking to its Growing Dataflow-as-a-Service Lineup

AI chip and systems specialist SambaNova today announced a new offering – SambaNova GPT Banking – intended to simplify and speed deployment of GPT models in the financial services industry. The new service is available now and becomes part of SambaNova’s expanding dataflow-as-a-service portfolio although pricing was not disclosed.

“Think of dataflow-as-a-service as the umbrella product family for the as-a-service offerings. We have three of them. There's one for language, one for computer vision and one for recommendation. Within the subcategory of language, we have GPT, and now we're extending that to an industry-specific GPT banking solution,” said Marshall Choy, SVP, product, in a briefing with HPCwire and EnterpriseAI.

GPT (generative pre-trained transformer) models have mushroomed in size and effectiveness in recent years. OpenAI’s GPT-3, the reigning king of GPT, has a capacity of 175 billion machine learning parameters. GPT models have proven extremely effective in natural language processing and new applications are constantly emerging.

Rodrigo Liang, CEO and co-founder of SambaNova, said in the official release, “GPT Banking has the potential to transform nearly every aspect of banking, from improving operations to managing risk and compliance. Customers tell me they’re most excited about GPT Banking’s ability to truly personalize the customer experience, with richer insights that enable them to understand customers' evolving needs.”

Within the banking industry SambaNova cites four prominent GPT applications:

- Sentiment analysis: scan social media, press and blogs to understand market, investor and stakeholder sentiment.

- Entity recognition: reduce human error, classify documents and reduce manual/repetitive work.

- Language generation: process, transcribe and prioritize claims, extract necessary information and create documents to improve customer satisfaction.

- Language translation: language translation to expand customer base.

“We built GPT Banking to improve bank's competitiveness and efficiency while accelerating their digital transformation,” stated Liang. “AI is the quickest and most cost-efficient tool to do that today and our service can be deployed and delivering value in weeks.” GPT Banking, says the company, is built for banks’ large language models and is offered as a subscription service to simplify the process of deploying the most advanced language models in a fraction of the time.

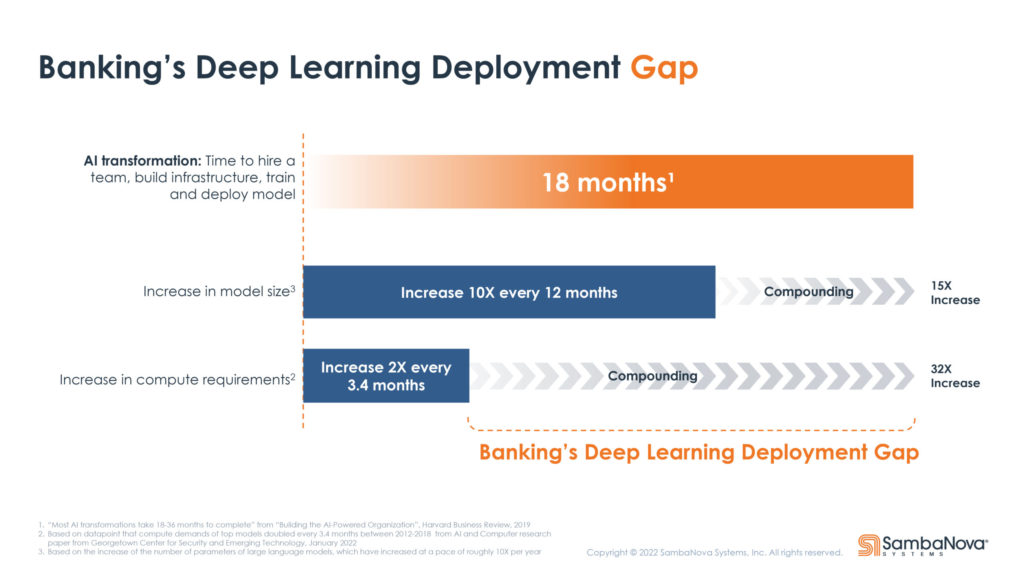

The big challenge with GPT, as with AI models broadly, is that training such large models is time-consuming and computationally intensive. Specialized hardware and software requirements along with scarce or absent in-house AI expertise are all significant obstacles. Like other AI chip/system newcomers, SambaNova has formidable hardware to sell (DataScale systems based on its proprietary AI chip) and is happy to sell it to you. But such large system sales are few and far between. One example is installation of a large SambaNova system at Lawrence Livermore National Laboratory, which has an abundance of expertise and (relatively speaking) budget.

Mainstreaming the use of large-model AI techniques, such as GPT, at least for now, seems better suited to the X-as-a-service approach. SambaNova prefers dataflow-as-a-service as the descriptor to emphasize the function rather than the infrastructure. It’s still not inexpensive but it is significantly easier and faster to deploy.

Choy said, “Let's face it, going to Lawrence Livermore, which we've done and sold them one, is one type of adoption. But the way this dataflow-as-a-service came up was I had customers who said what you've got with your DataScale product sounds great if you're Lawrence Livermore or Google, [but] I don't have 300 or 3000 data scientists. I don't have all the ML engineers. What I've got is a team of half a dozen people with a budget to expand that team from six to nine people in the next 18 months. What can you do for me?”

The larger market (revenue) for SambaNova is likely to be dataflow-as-a-service offerings rather than system sales, noted Choy. In practice, the company’s dataflow-as-a-service infrastructure is either co-located on your premises or hidden in a cloud. The models are largely pre-built by SambaNova then refined to reflect a client’s needs. Clients interact with the system via an API.

The larger market (revenue) for SambaNova is likely to be dataflow-as-a-service offerings rather than system sales, noted Choy. In practice, the company’s dataflow-as-a-service infrastructure is either co-located on your premises or hidden in a cloud. The models are largely pre-built by SambaNova then refined to reflect a client’s needs. Clients interact with the system via an API.

The GPT Banking offering is a good example of challenge and upside. Data control issues (confidentiality and security) loom large in the financial industry as they do in many commercial settings.

“What dataflow-as-a-service provides is a very clean break between the customer and us [with regard to] data privacy and data view-ability. Banking customers say, 'We cannot be handing over our data to you.' We agree. Our view is we're providing you with the service and the APIs to train the model. Then you're providing the data set, we never have possession or visibility in that data set, because that's your IP. It creates a very clean fence between us and customer data. We never see it. It just gets run through the model,” said Choy.

“Whether you're an end user, such as a bank or a cloud services provider who's going to be the intermediary, it's all the same. I'm deploying systems in your data center. I own and manage and maintain those systems, but you're putting them behind your firewall. What you have to tell me is you have to fill out my site planning guide, which is pretty straightforward – power, cooling, floor weight, dimensions of the door, etc. – so we can ensure the racks can roll in easily.”

This on-premises deployment model, said Chow, is emerging as a preferred approach across regulated industries with stringent data control regulations. “Others folks whose data is already up in the cloud, often want to go to the cloud. We can do that, too, we can put that into any number of cloud services providers,” he said.

Given the open-source availability of GPT models and the fact that SambaNova already has a GPT offering, one question is what real advantage does the GPT Banking offering provide. Choy said, “We found the general-purpose GPT model, whether that's ours or someone else’s, is okay for many things but not really great at anything. These are big models trained on big public datasets. They're effectively like Swiss Army knives. If you're in banking, you really care a lot about some specific downstream tasks like sentiment analysis, like text extraction, like document creation, like entity recognition. What we've done is we've taken the pre-trained GPT based model and done another step of pre-training with an industry specific needs.”

It will be interesting to monitor how SambaNova’s dataflow-as-a-service fares in the market. Hyperion Research analyst Steve Conway said, “SambaNova's strategy of offering a domain-specific GPT banking service makes good sense. AI is already highly useful, but isn't far enough along yet for versatile experiential learning products or services that can handle many domains effectively. Security is always a concern in the banking sector, but I'm sure SambaNova's services adhere to all the appropriate regulations and practices.”

Here's a link to the announcement.