AMD Reveals $35B Acquisition of Xilinx, Reports Record Q3 Revenue

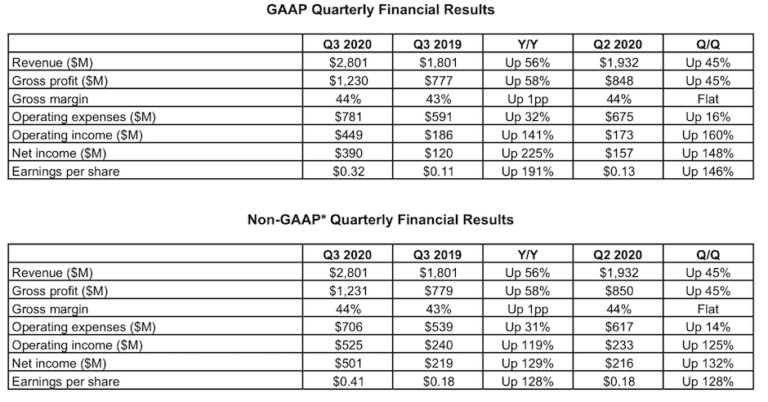

AMD this morning reported record quarterly revenue of $2.8 billion and a finalized deal to buy FPGA-maker Xilinx for $35 billion in an all-stock transaction. The acquisition helps AMD keep pace during a time of consolidation in the semiconductor industry. GPU rival and market leader Nvidia acquired Mellanox (interconnect) and has a deal to buy Arm (processor IP). AMD also reported GAAP net income of $390 million for the third quarter, which is up 225% from $120 million for Q3 one year ago.

“Our acquisition of Xilinx marks the next leg in our journey to establish AMD as the industry’s high performance computing leader and partner of choice for the largest and most important technology companies in the world,” AMD President and CEO Lisa Su said in the official announcement. “This is truly a compelling combination that will create significant value for all stakeholders, including AMD and Xilinx shareholders who will benefit from the future growth and upside potential of the combined company.”

AMD has been on a steady upward trajectory since its return to the server market with its Epyc microprocessor line in 2017. AMD is now seriously challenging Intel in the x86 processor market although Intel retains the dominant market share. Its return to the high-end server processor market was first marked by a price-performance strategy that has since evolved to a more balanced portfolio including leading-edge parts. AMD processors, as a result, are making their way into advanced supercomputers and will power what is now expected to be the first U.S. exascale system, Frontier, at Oak Ridge National Laboratory, which will feature both AMD microprocessors and GPUs.

“We are excited to join the AMD family. Our shared cultures of innovation, excellence and collaboration make this an ideal combination. Together, we will lead the new era of high performance and adaptive computing,” said Victor Peng, Xilinx president and CEO in the announcement. “Our leading FPGAs, Adaptive SoCs, accelerator and SmartNIC solutions enable innovation from the cloud, to the edge and end devices. We empower our customers to deploy differentiated platforms to market faster, and with optimal efficiency and performance. Joining together with AMD will help accelerate growth in our data center business and enable us to pursue a broader customer base across more markets.”

Under the terms of the agreement, Xilinx stockholders will receive a fixed exchange ratio of 1.7234 shares of AMD common stock for each share of Xilinx common stock they hold at the closing of the transaction. Based on the exchange ratio, this represents approximately $143 per share of Xilinx common stock. Post-closing, current AMD stockholders will own approximately 74 percent of the combined company on a fully diluted basis, while Xilinx stockholders will own approximately 26 percent. The transaction is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

The Wall Street Journal noted:

“Xilinx would also give AMD a foothold in areas where it’s a small player or entirely absent, including telecommunications infrastructure and defense. Xilinx chips are used in the U.S.’s latest combat plane, the Lockheed Martin Corp. F-35 Joint Strike Fighter. They’re also commonly used in superfast 5G network infrastructure.

“Financially, the deal, on closing, would immediately improve AMD’s profit margins, earnings and cash generation, the company said. The move could also aid AMD in reaching its goal of 20% annual revenue growth over the next few years.”

AMD expects to achieve operational efficiencies of approximately $300 million within 18 months of closing the transaction, primarily based on synergies in costs of goods sold, shared infrastructure and through streamlining common areas. The company reported diluted earnings per share for Q3 of $0.32, which are up 191% from $0.11 one year ago.

A snapshot of AMD’s reported financial results is below.

EnterpriseAI will continue coverage of this story as details emerge.