GlobalFoundries Has Started Its IPO Process – Now What?

Since July, semiconductor maker GlobalFoundries has been the subject of rumors and news reports that said the company was the takeover target of market leader Intel Corp. or that it might be pursuing an IPO.

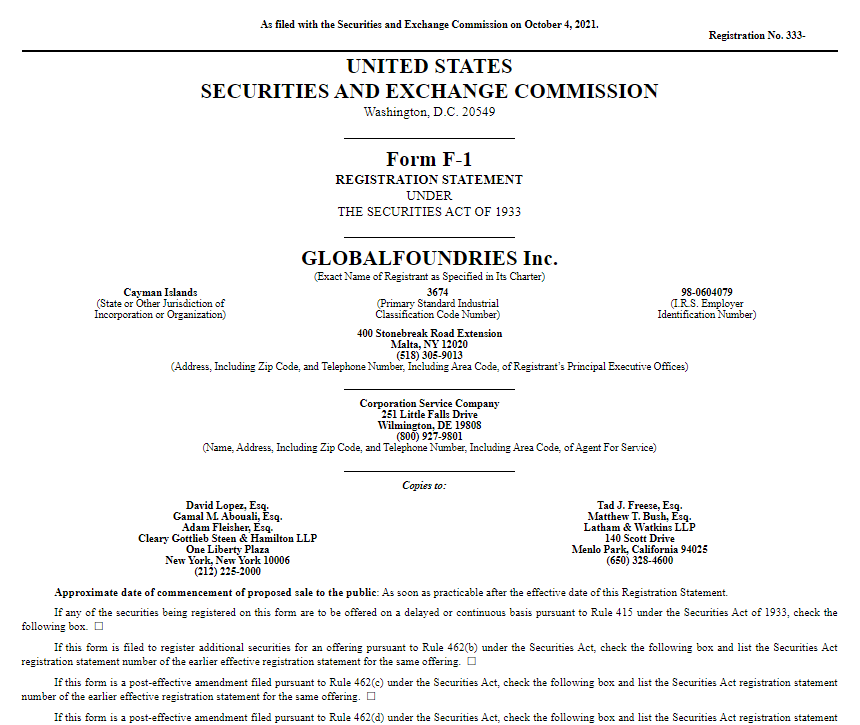

Well, while no Intel takeover attempt has officially surfaced, GlobalFoundries confirmed the IPO rumors on its own by filing the needed paperwork on Oct. 4 with the U.S. Securities and Exchange Commission, starting a path toward a potential initial public offering in the future.

The Form F-1 that was filed does not yet set a share price or designate the number of shares that will be offered, according to the company’s press release about the filing.

In its more than 200-page filing with the SEC, GlobalFoundries stated that was applying to list its ordinary shares on the Nasdaq Global Select Market under the ticker symbol “GFS.”

The IPO process is being handled for the company by Morgan Stanley, Bank of America Securities, J.P. Morgan, Citigroup and Credit Suisse, according to the filing. Other book-running managers for the proposed offering include Deutsche Bank Securities, HSBC and Jefferies, while Baird, Cowen, Needham & Company, Raymond James, Wedbush Securities, Drexel Hamilton, Siebert Williams Shank and IMI – Intesa Sanpaolo are acting as co-managers.

The proposed offering will be made only by means of a prospectus, the filing states.

While the Form F-1 registration statement has been filed in connection with the IPO, it has not yet become effective pending a review by the SEC. The securities are not yet for sale.

The form tentatively lists the aggregate amount to be raised by the IPO at $1 billion, though it is likely that the total actual amount raised will be many times that total.

Owned by Mubadala Investment Co., which is an investment arm of the Abu Dhabi government, GlobalFoundries is based in the U.S. and was created in 2008 when it was spun off by Intel rival AMD.

Owned by Mubadala Investment Co., which is an investment arm of the Abu Dhabi government, GlobalFoundries is based in the U.S. and was created in 2008 when it was spun off by Intel rival AMD.

A spokesperson for GlobalFoundries confirmed the filing to EnterpriseAI, adding that “the timing for the marketing and subsequent listing is subject to the SEC’s review process.”

An August report by Reuters seems to have accurately mapped out the path that the GlobalFoundries’ IPO has taken so far. That Aug. 18 report said the company was pursuing an IPO in the United States through a confidential filing meant to keep the application out of the limelight at the time.

“The move is the clearest sign yet that GlobalFoundries … is not eager to accept a potential tie-up with Intel Corp.,” the Reuters story said. “GlobalFoundries is working with Morgan Stanley, Bank of America Corp., JPMorgan Chase & Co., Citigroup, Inc. and Credit Suisse Group AG on the IPO preparations,” which all turned out to be involved in the process.

That original story also stated that the IPO filing by GlobalFoundries would be revealed in October and will go public by the end of 2021 or by early 2022, “depending on how quickly its application is processed by the U.S. Securities and Exchange Commission (SEC), the sources said.”

Bob O’Donnell, an analyst with TECHnalysis Research, told EnterpriseAI that the GlobalFoundries IPO application makes sense for the company, especially after the rumors of a possible acquisition attempt by Intel surfaced in July.

“This is the perfect time” for an IPO by the company, said O’Donnell. “The world has never been more aware of and concerned about diversity of semiconductor suppliers than we are right now. It is perfect market timing, and sometimes that is what drives these things.”

Companies like GlobalFoundries are in big demand today due to the ongoing chip shortage caused by supply chain and manufacturing problems and complications caused globally by the COVID-19 pandemic. Manufacturers of everything from automobiles, trucks, consumer goods, electronics and more are running into chip supply issues that have severely squeezed supplies of a wide range of products around the world.

These supply chain issues and chip shortages play into GlobalFoundries hands, said O’Donnell. “In my mind, it makes perfect sense for them to maximize investor interest” with the IPO now. “The bigger questions are longer term [about] ownership, because right now it is all owned by the company in Abu Dhabi.”

GlobalFoundries has a large fab plant in Malta, New York, and other manufacturing facilities in Germany and Singapore. The company is the third largest chip fab in the world in terms of volume, behind market leader TSMC and Samsung.

“The IPO is important because it is going to give them – in theory – access to more capital, which is going to allow them to expand, which the market absolutely wants,” said O’Donnell. “And that is important because even though GlobalFoundries doesn't make anything below 12nm in size, they make a staggering amount of chips [and that is] where they make most of their revenue.” These are chips that while not built on the bleeding edge, they are important to a wide range of industries, from automotive to telco and more, he added.

Another analyst, Kevin Krewell of TIRIAS Research, agreed.

“GlobalFoundries has established a solid global foundry business with a differentiated offering,” said Krewell. “Its plan is to build a profitable business with investments from key customers to reach its capacity. The company is also important for global semiconductor supply chain diversity when it comes to process technology and geographic fab locations, including in the U.S. The IPO should provide funds for further expansion.”

In July, reports swirled that Intel was pursuing a $30 billion acquisition of GlobalFoundries. And just days after those initial reports, GlobalFoundries announced that it would spend $1 billion to add needed chip manufacturing capacity as soon as possible at its fab plant in Malta, N.Y., while also unveiling its intentions to add an all-new fab plant that will double its overall chip production. The moves were meant to help resolve ongoing U.S. semiconductor supply chain shortages.

The coming investments are part of the company's broader global expansion plans that include the recently announced new fab in Singapore and $1 billion planned investment to expand in Germany, which are being done to meet the growing demand from customers worldwide.

The $1 billion investment by GlobalFoundries into its existing Fab 8 facility was being made immediately to help address the global chip shortages, according to the company, while the planning and construction of an all-new fab facility will follow as public and private partnership negotiations and funding options are pursued. The Fab 8 expansion, which will occur within the existing facility’s footprint, will add an additional 150,000 wafers per year to the company’s present production capabilities within its existing fab.

In April, GlobalFoundries also announced that it is moving its corporate headquarters to Malta, where it has its most advanced semiconductor manufacturing facilities.