Toyota, GM Sign Tech Partners to Expand Vehicle Advanced Driver-Assistance Capabilities

With cars and trucks constantly gaining new driver-assistance features to increase on-the-road safety, two of the world’s largest automakers are bringing in new partners to help boost their technologies.

In the latest moves, Toyota has signed on ZF and Mobileye to develop advanced driver-assistance systems (ADAS) for several of its vehicle platforms in the next few years, while General Motors has licensed a powerful AI software system from the Department of Energy’s Oak Ridge National Laboratory (ORNL) that uses convolutional neural network technology.

Under the Toyota deal, ZF will collaborate with Mobileye, an Intel company, to combine Mobileye’s vision computing system with ZF’s mid-range radar technology to more accurately “view” the environment outside a Toyota vehicle to mitigate collisions, according to a May 18 (Tuesday) news release from Toyota. ZF makes computer vision cameras and other safety-related components for vehicles.

Under the GM deal with ORNL, the automaker has licensed a powerful AI software system from ORNL to speed up ADAS development in its cars and trucks. The software, called Multinode Evolutionary Neural Networks for Deep Learning (MENNDL), was created at ORNL in 2014 and is used to design algorithms that recognize patterns in datasets of text, images and sounds. GM is the first commercial enterprise to license MENNDL from ORNL for use outside the laboratory.

Toyota, ZF and Mobileye

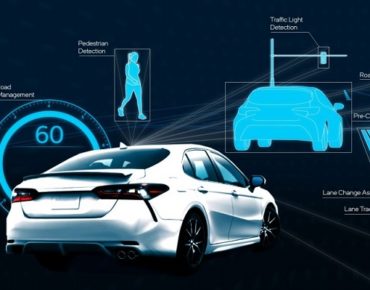

For Toyota, Mobileye’s EyeQ4 vision computing system-on-chip (SoC) will be combined with ZF’s Gen 21 mid-range radar technology to help prevent and mitigate collisions while yielding best-in-class lateral and longitudinal vehicle control, according to Intel. The EyeQ4 combines enhanced computational capabilities with computer vision algorithms to rapidly process information from a vehicle’s front-facing camera to provide ADAS capabilities.

Mobileye’s EyeQ4 applies enhanced computational capabilities with computer vision algorithms while rapidly processing information from the vehicle’s front-facing camera. Image credit: Mobileye

The ZF Gen21 mid-range radar is a high-performance 77GHz front radar designed to meet 2022+ Euro NCAP 5-star vehicle safety ratings and enable L2/L2+ automated driving functions for automakers. It also works to provide a wide field of view at low speeds to assist in pedestrian detection to be used with other systems including automatic emergency braking and a longer detection range at high speeds for systems like adaptive cruise control.

“Toyota decided to choose Mobileye and ZF's ADAS product following a detailed evaluation of the system capabilities as well as its competitiveness in the market,” Erez Dagan, Mobileye executive vice president for products and strategy, told EnterpriseAI. “This partnership reflects a shared vision by Mobileye, ZF and Toyota, to make roads safer through advanced safety features.”

The Mobileye EyeQ SoC uses many different image processing algorithms which enable the perception capabilities and logic framework being used by Toyota for driver assistance applications, said Dagan. “These algorithms, which based on a variety of AI, DL, and other data processing models and paradigms, support ADAS features like lane-keeping, adaptive cruise control, automated emergency braking, and more.”

GM and MENNDL

The use of the MENNDL software by GM provides huge benefits by allowing neural networks to train themselves to speed up their development, said Robert M. Patton, the group leader for learning systems at ORNL.

Typically, neural networks are uniquely designed and trained to solve one kind of problem, Patton told EnterpriseAI. “That’s the difficulty there,” he said. Each time you want to develop a neural network to design or build something, it can take more time to build the neural network than it could take to build or design the actual product, he said. “It could take months, maybe even a year if you don’t give up.”

But MENNDL solves those problems because it can learn from its failures as well as from its successes and it can speed the time to finding answers to inquiries, automating the process, said Patton.

“Over time, it begins to evolve the architecture and weeds out the failures and starts driving towards a neural architecture that works for that application, or at least works for the training data that you give it,” said Patton.

At ORNL, much of that development work was done using MENNDL on the facility’s Summit supercomputer, which has been used to create neural networks that can detect cancer markers in biopsy images much faster than they can be detected by doctors, said Patton.

The work with GM and MENNDL is a perfect fit for ORNL, he said.

“We have ongoing research collaborations with [many automakers] on a variety of different topics and as autonomous vehicles begin to emerge and artificial intelligence start showing more and more promise, this is where the discussion comes with the automakers,” said Patton. But this is really hard. And everybody has a hard time with artificial intelligence when you first get started with a new application.”

That’s when ORNL approached GM and detailed its MENNDL technology for solving some of the problems GM is working to solve, he said.

For GM, a key application area is with autonomous vehicles, but Patton said he could not share specifics. MENNDL will also be able to be used for improved auto designs, he said, including refinements in aerodynamics, performance and more.

“There's a lot of parameters there to be optimized,” he said. “That is where artificial intelligence could be used in the design process to help you find those optimizations.”

Automaker Tech Partnerships: Analyst Reactions

These kinds of partnerships between tech companies and consumer products makers like automakers make lots of sense, several analysts told EnterpriseAI.

“Many automobile manufacturers are experts in making automobiles efficiently, effectively, and profitably,” said Marc Staimer, president and chief data scientist with Dragon Slayer Consulting. “But they are not experts in AI, machine learning, deep machine learning and autonomous driving. So partnering with those who are speeds time to market and provides a better system. In the end is that any different than these automobile manufacturers partnering with tire, steel, battery, electronics, etc. manufacturers?”

R. Ray Wang, principal analyst with Constellation Research, said this is even more so in the autonomous vehicle marketplace where battle lines are hardening.

“On one hand, there is LIDAR, which Toyota is going with, and computer vision, which is what Tesla and GM are betting on,” said Wang. While MENNDL’s convolutional neural network is one of the most advanced and is optimized for pattern recognition, said Wang, Mobileye’s approach is powerful in providing redundant systems of cameras and radar. “This true redundancy is great out of the box, but is not as smart, while the MENNDL approach is super smart, but needs large sets of training data to optimize.”

The two technologies will eventually converge, said Wang, “but the partnerships are key for these automakers to catch up with Tesla and Volvo which are the gold standard.”

Another analyst, Kevin Krewell with Tirias Research, said the two automakers are taking very different approaches.

“The GM deal with Oak Ridge National Labs to use its AI models is a signal that GM wants to develop its own technology platform for autonomous driving,” said Krewell. “The [Toyota] deal is a typical Toyota conservative deal. ZF and Mobileye are well known suppliers. The GM deal is more aggressive as the company wants to develop in-house capability and not be dependent on third-party technologies. It represents a long-term vision for GM.”

For GM, it will still need a hardware platform to run the AI models, but those could be done in-house, he said.

Dan Maycock, principal analyst with Loftus Labs, said that automakers working with other companies on technologies where they have less expertise could also be harbingers of more long-term and formal relationships.

“It can sometimes be a precursor to assessing companies for acquisition and wanting to kick the tires before moving forward with an acquisition and in other cases, it’s building an ecosystem of complementary partners to more rapidly innovate,” said Maycock. “As the demand for AI and ML increases though, the cost of talent and difficulty in acquiring largescale AI/ML teams will increase these types of partnerships over time.”