IBM Reports 2020 Third-Quarter Results

ARMONK, N.Y., Oct. 19, 2020 -- IBM today announced third-quarter 2020 earnings results.

“The strong performance of our cloud business, led by Red Hat, underscores the growing client adoption of our open hybrid cloud platform," said Arvind Krishna, IBM chief executive officer. "Separating the managed infrastructure services business creates a market-leading standalone company and further sharpens our focus on IBM's open hybrid cloud platform and AI capabilities. This will accelerate our growth strategy and better position IBM to seize the $1 trillion hybrid cloud opportunity.”

Highlights for the third quarter include:

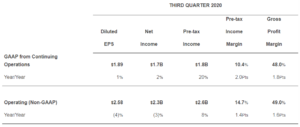

- GAAP EPS from continuing operations of $1.89

- Operating (non-GAAP) EPS of $2.58

- Revenue of $17.6 billion, down 2.6 percent (down 3.1 percent adjusting for divested businesses and currency)

-- Cloud & Cognitive Software revenue up 7 percent (up 6 percent adjusting for currency) - Total cloud revenue of $6.0 billion, up 19 percent

-- Total cloud revenue of $24.4 billion over the last 12 months, up 22 percent (up 25 percent adjusting for divested businesses and currency) - Red Hat revenue up 17 percent (up 16 percent adjusting for currency), normalized for historical comparability

- GAAP gross profit margin of 48 percent, up 180 basis points; Operating (non-GAAP) gross profit margin of 49 percent, up 160 basis points

- Net cash from operating activities of $15.8 billion and free cash flow of $10.8 billion, over the last 12 months

“In the third quarter we continued to deliver strong gross profit margin expansion, generated solid free cash flow and maintained a sound capital structure with ample liquidity," said James Kavanaugh, IBM senior vice president and chief financial officer. "We have the necessary financial flexibility to increase our investments in hybrid cloud and AI technology innovation and skills, while remaining committed to our long-standing dividend policy.”

Cash Flow and Balance Sheet

In the third quarter, the company generated net cash from operating activities of $4.3 billion, or $1.9 billion excluding Global Financing receivables. IBM’s free cash flow was $1.1 billion. The company returned $1.5 billion to shareholders in dividends.

IBM ended the third quarter with $15.8 billion of cash on hand which includes marketable securities, up $6.7 billion from year-end 2019. Debt, including Global Financing debt of $20.9 billion, totaled $65.4 billion.

Segment Results for Third Quarter

Segment results reflect growing adoption of IBM's open hybrid cloud platform while clients continue to shift priorities to preserve cash and maintain operational stability.

- Cloud & Cognitive Software (includes Cloud & Data Platforms which includes Red Hat, Cognitive Applications and Transaction Processing Platforms) — revenues of $5.6 billion, up 7 percent (up 6 percent adjusting for currency). Cloud & Data Platforms, grew 20 percent (up 19 percent adjusting for currency) led by Red Hat. Cognitive Applications grew 1 percent (flat adjusting for currency), led by Security and Supply Chain. Transaction Processing Platforms declined. Cloud revenue grew more than 60 percent.

- Global Business Services (includes Consulting, Application Management and Global Process Services) — revenues of $4.0 billion, down 5 percent (down 6 percent adjusting for currency), driven by declines in Application Management and Consulting. Cloud revenue up 10 percent (up 9 percent adjusting for currency). Gross profit margin up 190 basis points.

- Global Technology Services (includes Infrastructure & Cloud Services and Technology Support Services) — revenues of $6.5 billion, down 4 percent. Cloud revenue up 9 percent (up 8 percent adjusting for currency).

- Systems (includes Systems Hardware and Operating Systems Software) — revenues of $1.3 billion, down 15 percent (down 16 percent adjusting for currency), driven by declines in IBM Z and Storage Systems, reflecting the impact of product cycle dynamics.

- Global Financing (includes financing and used equipment sales) — revenues of $273 million, down 20 percent, reflecting the wind-down of OEM commercial financing. Gross profit margin up 60 basis points.

Year-To-Date 2020 Results

Year-to-date results reflect transaction-related impacts associated with the Red Hat acquisition, which closed in July 2019.

Consolidated diluted earnings per share was $4.72 compared with $6.45 per diluted share for the 2019 period, a decrease of 27 percent. Consolidated net income was $4.2 billion, down 27 percent year to year. Revenues for the nine-month period ended September 30, 2020 totaled $53.3 billion, a decrease of 4 percent year to year (down 2 percent adjusting for divested businesses and currency) compared with $55.4 billion for the first nine months of 2019.

Operating (non-GAAP) diluted earnings per share from continuing operations was $6.60 compared with $8.10 per diluted share for the 2019 period, a decrease of 19 percent. Operating (non-GAAP) net income for the nine months ended September 30, 2020 was $5.9 billion compared with $7.2 billion in the prior-year period, a decrease of 18 percent.

More info: https://newsroom.ibm.com/2020-10-19-IBM-Reports-2020-Third-Quarter-Results

Source: IBM Corp.