GPU Market Posts Unexpected Q2 Gains

Nvidia Ampere A100 GPU

The booming graphics processor market is not immune to pandemic uncertainty, with forecasting metrics such as “seasonality” becoming increasingly problematic.

For instance, graphics board shipments jumped 6.6 percent sequentially in the second quarter, up 36.7 percent year-on-year, according to GPU market analyst Jon Peddie. In a normal year, those gains would likely have shown up during the third quarter, fueled by increased back-to-school desktop and tablet sales.

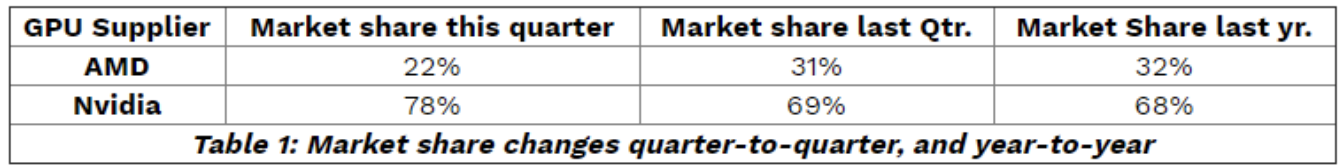

Market leader Nvidia Corp. (NASDAQ: NVDA) was again the main beneficiary, boosting its share of the graphics add-in board market by nine percentage points during the previous quarter to a dominant 78 percent.

Nvidia’s market expansion came at the expense of AMD (NASDAQ: AMD), the other primary supplier to the $14.8 billion GPU board sector. AMD saw its market share decline to 22 percent, down 10 percentage points over the same period last year, Peddie reported.

Waiting in the wings is Intel Corp. (NASDAQ: INTC), which is expected to enter the discrete GPU market later this year. Last year, before the chip maker acknowledged significant production problems at its 10- and 7-nanometer nodes, Intel said its first 7-nm device would be a GPU targeting datacenter and HPC applications.

The chip would serve as the heart of the graphics engine for the U.S. Energy Department’s Aurora supercomputer previously scheduled to come online next year. Process technology delays at Intel have delayed the HPC launch.

Discrete GPUs end up in everything from desktops to servers. Add-in boards using discrete graphics processors are considered the high-end of the board market as they often require large amounts of high-speed memory and interconnects.

While unexpected increases in quarterly demand are welcome, Peddie and other industry trackers worry that second quarter gains may foreshadow a third quarter decline.

“Investors are worried that the unseasonal increase in [GPU board] shipments in Q2 is due to a pull-in of sales that would normally be sold in Q3 [and] will cannibalize traditional Q3 sales,” Peddie said this week in a research note.

AMD and Nvidia are nevertheless each forecasting “robust” third-quarter demand, “and consumer sentiment is improving to support their expectations,” Peddie added.

Meanwhile, new graphics boards are expected from AMD and Nvidia, and analysts predict Intel might enter the graphics board market by the end of the quarter.

Wavering consumer sentiment, uncertain enterprise demand and unseasonable seasonality are combining to make GPU forecasts more difficult. Nevertheless, the graphics board sector is forecast to hit $16.7 billion by 2023, Peddie said.

Related

George Leopold has written about science and technology for more than 30 years, focusing on electronics and aerospace technology. He previously served as executive editor of Electronic Engineering Times. Leopold is the author of "Calculated Risk: The Supersonic Life and Times of Gus Grissom" (Purdue University Press, 2016).