Bitcoin is Having a ‘Halving’ Amidst a Pandemic

In the world of Bitcoin a “halving” takes place about every four years. This past Monday, May 11, 2020, witnessed the third such event. It’s a big deal. It points to the steady maturing and acceptance of Bitcoin in particular and cryptocurrencies in general. That it happened in the middle of a pandemic and economic shutdown gives it more visibility as a new asset class and arguably a safe store of value. Here’s an explanation of the highlights of what that means and why it happens.

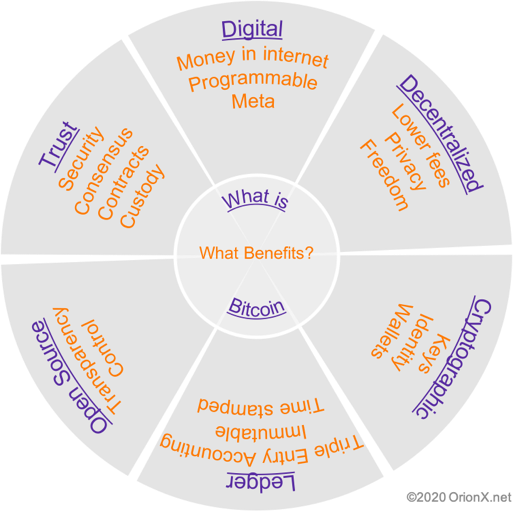

What is Bitcoin?

Bitcoin was developed by an unknown person (or persons) who presented himself as Satoshi Nakamoto. The main Bitcoin paper was published in October 2008 during the financial crisis, another challenging economic period.

Bitcoin was the first digital money to solve the double spending problem of duplicate transactions. It is a delicately balanced blend of several forces to create a digital currency that is simultaneously:

- Digital: which means it can be instantly, electronically moved around, it easily lends itself to program trading or “smart contracts,” and it can represent different types of value.

- Decentralized: all participants can see and access all transaction records since all nodes in the system can, and many do, hold a copy of the entire history of all transactions.

- Cryptographic: It uses cryptography to protect wallets and owners by using digital signatures (hashes) that act as addresses for wallets, transactions, and blocks of transactions.

- A blockchain ledger: Bitcoin operates as an immutable, always-go-forward-never-back, ledger that lives in the Internet. The triple entry ledger is made up of transaction blocks that are chained together, each pointing to the block before it. These blocks represent the definitive and irreversible account of the entire Bitcoin market history, with thousands of copies held by any computer that requests a copy.

- Transparent: the computer code is Free Open Source Software. It is estimated that over 40,000 computers around the world currently run the Bitcoin code. Watching Bitcoin transactions is like looking at a stock ticker tape where you know how many shares were bought at what price, but you also see the parties’ cryptographic addresses, their pseudonyms. While pseudo-anonymity is possible in principle, the enforcement of Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance laws is standard practice by major gateways into the system, and Bitcoin’s open ledger provides significant meta-data that can be used to trace transactions.

- Trusted: Bitcoin provides incentives to all participants to behave well and aims to make misbehavior too costly to consider. The fact that it has held up for over a decade is cited as a testament to the effectiveness of this arrangement. The ledger itself has never been compromised even though people have lost access to their Bitcoin because they lost the password to their digital wallets or – in a few famous cases – companies with custody of people’s Bitcoins collapsed or disappeared.

Fixed Supply, Gradually Issued

Bitcoin has a fixed supply of 21 million Bitcoins. These coins are introduced into the system gradually with each transaction block. How do you know what transactions should be in a block when there are thousands of nodes in the network looking at all the transactions? You reward the nodes that take on the task of collecting and validating transactions with freshly minted Bitcoins and transaction fees. The new block becomes the new head of the growing blockchain since it includes a pointer to the block at the head of the chain. Only the longest chain of transaction blocks survives.

Bitcoin has a fixed supply of 21 million Bitcoins. These coins are introduced into the system gradually with each transaction block. How do you know what transactions should be in a block when there are thousands of nodes in the network looking at all the transactions? You reward the nodes that take on the task of collecting and validating transactions with freshly minted Bitcoins and transaction fees. The new block becomes the new head of the growing blockchain since it includes a pointer to the block at the head of the chain. Only the longest chain of transaction blocks survives.

Miners

To prevent misbehavior, these nodes must solve a computationally challenging puzzle: a cryptographic random search, using trial and error. A node that undertakes this effort and solves the puzzle before anyone else has thus provided “Proof of Work,” “mined” the new Bitcoins that come with each block and receives the transaction fees in the block. Little wonder that Bitcoin has become known as digital gold, complete with the mining analogy.

Protecting the Chain

Having more computational resources increases the chances of solving the puzzle before anyone else. Hijacking the system is a foolish thought because the hijacker must maintain the longest chain, battling it out with the rest of the miners, whereas applying the same resources to solving the problem is more likely to win the reward. Solving the puzzle has no benefit other than to grant the lucky winner the right to confirm the transaction block and reap the rewards. Its sole purpose is to create a mix of incentives to establish trust in a decentralized fashion.

Every 10 Minutes

The difficulty of the puzzle is dynamically adjusted based on an estimate of all mining resources. This is to make sure that, on average, a new transaction block takes 10 minutes to be solved. It is believed that Satoshi assumed that it would take about one minute to let all miners know that the current block has been solved so they can move to the next. In that minute they would continue to mine unnecessarily, so setting the block time to about 10 minutes would limit such unnecessary work to about 10 percent, and that was viewed as a reasonable balance.

Bitcoin Time and Calendar

If you think of a Bitcoin block as its own constant unit of time, you can work out a whole calendar system based on the progression of the Bitcoin ledger. My colleague Stephen Perrenod has devised exactly such a system (see Living on Satoshi Time: What Block is it?).

What is Halving?

Bitcoin started out issuing 50 coins for each block, to be halved every 210,000 blocks. If each block is likely to take about 10 minutes, that works out to about 4 years. The first Bitcoin block with 50 Bitcoins was mined by Satoshi in January 2009. The first halving took place a bit less than four years, on Nov 26th, 2012, after which the block reward dropped to 25 coins. The second halving was on July 11th, 2016 when the reward became 12.5 coins. With this third having, we are at 6.25 coins per block.

Impact on Bitcoin Supply

Each Bitcoin halving has been anticipated for at least four years, a major topic of analysis, predictions and global parties. Halvings are closely studied since they significantly change the economics of mining and reduce the flow of new stock.

With this latest halving the total supply of Bitcoin will grow less than 2 percent per year. That is on par with and slightly less than the 2 percent at which the supply of gold has typically grown. Of the 21 million total Bitcoins, over 18 million (87.5 percent-plus) have been mined already. The total number will not be reached sometime around the year 2140. The last Bitcoin will be mined in very small portions over decades.

Impact on Fees and Market Cap

While Bitcoin’s price has been volatile, it has generally been on a long-term upward move, especially following the first halving. While halvings are, in practice, partially priced in by miners, the change is an opportunity to experiment with raising transaction fees. In fact, transaction fees have been rising in the run up to the most recent halving. This is consistent with expectations. The plan has always been to gradually transition the incentive model for miners, from enticing them with newly mined coins to keeping them with transaction fees as the number of new coins drop and the market becomes better established.

There are many models that aim to predict Bitcoin’s market cap in dollars. A popular stock-to-flow model from PlanB predicts an Average Bitcoin Price of $288,000 by 2024. While that sets an upper bound, other models are closer to the ground. With reference again to my colleague Stephen Perrenod, he has created a model (A Future Supply Model for Bitcoin’s Market Cap) based on residual supply of Bitcoins that predicts an asymptotic price of $77,538. There are so many variables in play, however, that all become essentially an exercise in understanding how just a subset of market forces might influence the price.

Bitcoin came on the scene during the last major economic recession. Over time, it has become better understood and has established itself as a new asset class, a store of value, and immune to changing money supplies. We have been in the start-up phase of Bitcoin when its behavior was designed to cultivate the market, attract participants and keep them with sticky benefits. Everything about it will gradually change towards a less volatile environment as the impact of new coins on supply (existing coins) decreases and the use of Bitcoin as medium of exchange matures. This halving is a major step in that direction.

Note: OrionX is not offering financial advice nor endorsing any particular product, company or organization mentioned in this article.)

Shahin Khan is a partner at OrionX, a technology industry consulting company, and contributing editor to this publication.