AMD’s Q1 Sets Records and Meets Expectations, but COVID-19 Looms

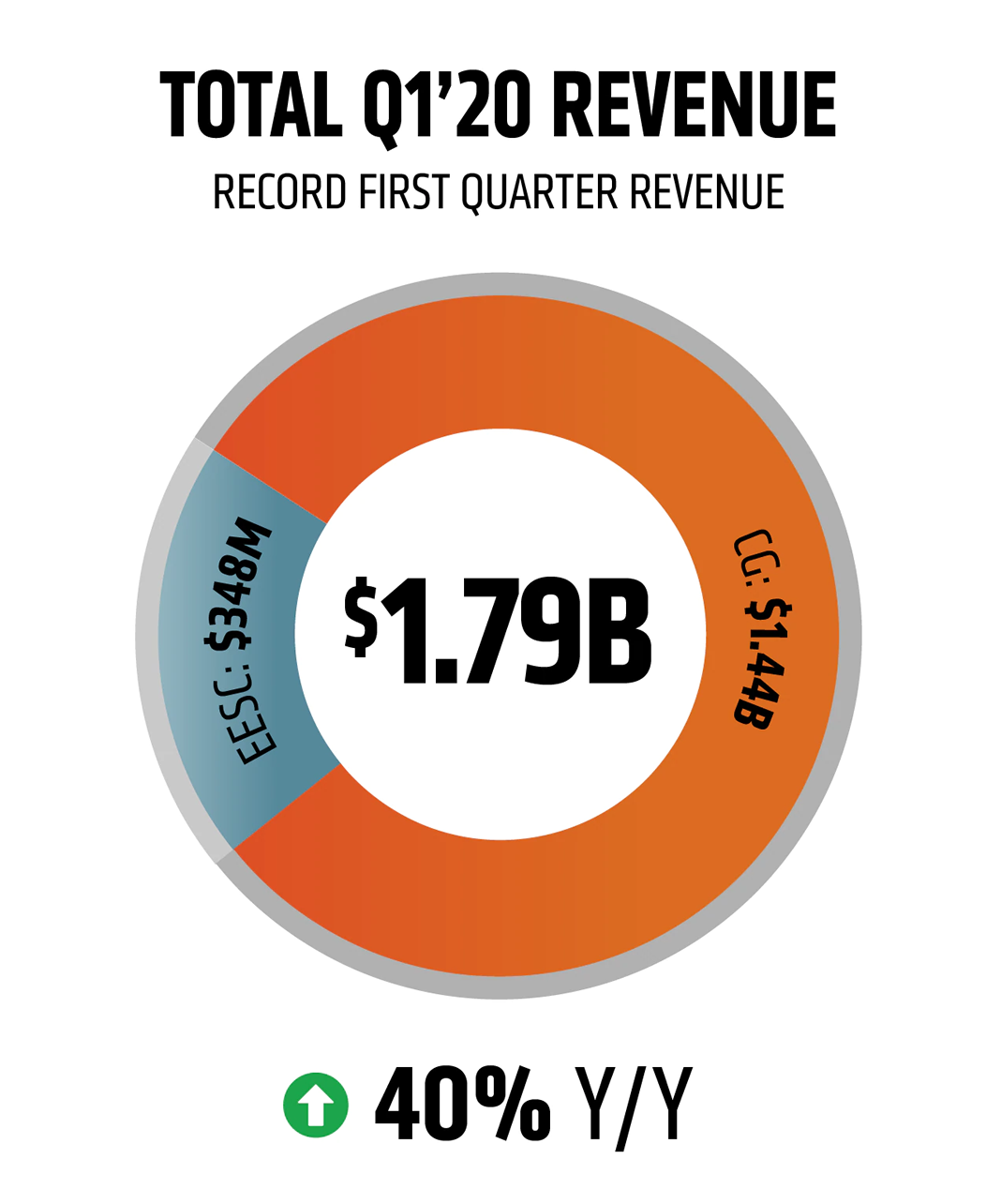

AMD has reported its Q1 2020 revenue, slightly outperforming analyst expectations and dodging the first financial blows of COVID-19 to deliver $1.79 billion – a whopping 40 percent year-over-year growth in revenue, and a record for first-quarter earnings.

The year-over-year growth was primarily driven by the computing and graphics segment, which was up 73 percent compared to the same quarter last year. The enterprise, embedded and semi-custom segment, however, was down 21 percent year-over-year despite higher sales of AMD’s Epyc processors.

“With 40% growth, AMD had a monster quarter, revenue wise, and set some records in the process,” said Patrick Moorhead, president and principal analyst of Moor Insights & Strategy. “As the company forecasted last quarter, its gross margin was up 5 basis points with a richer notebook mix and the expected reduced console chip sales before the next generation consoles come online.”

Unit shipments for servers more than tripled year-over-year for Q1, which AMD CEO Lisa Su attributed to momentum with enterprise, HPC and – especially – cloud customers. “We saw particular strength with cloud providers introducing new instances and accelerating current deployments,” said Su. “Microsoft Azure, Google and IBM all announced new offerings powered by second-generation Epyc processors.”

Unit shipments for servers more than tripled year-over-year for Q1, which AMD CEO Lisa Su attributed to momentum with enterprise, HPC and – especially – cloud customers. “We saw particular strength with cloud providers introducing new instances and accelerating current deployments,” said Su. “Microsoft Azure, Google and IBM all announced new offerings powered by second-generation Epyc processors.”

Su said the company would continue to ramp its server business and that the next-generation Epyc processor, Milan, is on track to launch later this year.

Su also highlighted AMD’s wins with major supercomputing deployments, such as the forthcoming exascale El Capitan system at Lawrence Livermore National Laboratory (LLNL). “We are incredibly proud that two of the three publicly announced U.S. exascale supercomputing systems will exclusively use AMD CPUs and GPUs,” Su said, “clearly positioning AMD as the exascale computing leader based on our high-performance computing and graphics technologies and software capabilities.”

Despite all this, however, AMD stock fell around four percent in after-hours trading after its revised expectations for Q2 landed at a slightly lower $1.85 billion (a 21 percent increase year-over-year). This outlook, AMD CFO Devinder Kumar, “contemplates the current COVID-19 environment and customer demand signals.” Overall, for 2020, AMD expects annual revenue growth of 25 percent (plus or minus five percent), “despite expectations of weaker COVID-19-related consumer demand in the second half of the year.” Most of this growth is expected to be driven by Epyc processor sales and semi-custom sales.

“I’m pleased with our execution in the quarter, as we quickly adopted our global operations to navigate pockets of supply chain disruption and addressed geographic and market demand shifts caused by COVID-19,” Su said.

“Our long-term strategy and growth drivers remain unchanged,” Su assured. “Although there are some near-term uncertainties in the demand environment, we are well-positioned to navigate through this situation. We have a solid financial foundation and our product portfolio is very well positioned across the PC, gaming and datacenter markets.”

AMD also took time to highlight its efforts to fight back against the pandemic by providing its technology – and even, in some cases, PPE – to COVID-19 researchers. A couple of weeks ago, AMD announced a COVID-19 HPC fund with an initial donation of $15 million in hardware to support researchers, and just a few days ago, LLNL used AMD tech to upgrade its Corona system for COVID-19 research.

Overall, AMD communicated confidence in its earnings against the “backdrop” of COVID-19. AMD, of course, is no stranger to uphill battles, having successfully leveraged its underdog status to haul its share price from two dollars and change in 2015 to over $53 today.