AMD’s Road Ahead: 5nm Epyc, CPU-GPU Coupling, 20% CAGR

AMD CEO Lisa Su

Promising Wall Street a 20 percent CAGR and an aggressive CPU-GPU product roadmap, AMD delivered a confident self-portrait at its financial analyst day in Santa Clara yesterday that’s at odds with a world economy fearful of a potential pandemic -- and also at odds with nemesis Intel, the chip industry overlord that let AMD steal a price/performance march into the 7-5-3nm future.

Among the highlights: AMD finally confirmed what had long been suspected, that its Epyc CPU due in 2022 will be 5nm; that it has under development an architecture that tightly integrates CPU-GPU operations; and that coronavirus will have little or no impact on the company’s existing short-term growth projections.

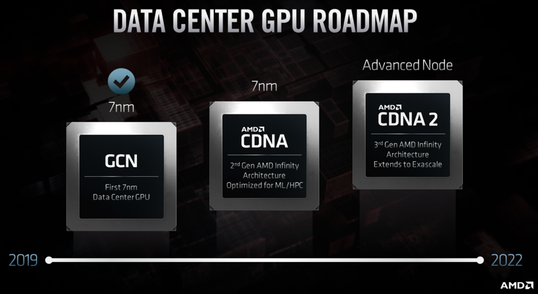

In its presentations, the company placed particular emphasis on the data center market, both on-premises enterprise and hyperscaler/cloud services, which CEO Lisa Su said will be a $35 billion TAM by 2023. The company is making an aggressive move in GPUs for data center-based AI/machine learning workloads, announcing a GPU architecture, called CDNA, that is a compute-focused counterpart to the company’s RDMA GPU architecture for gaming.

In this way, AMD is mounting an effort to compete with Nvidia’s leadership in data center GPUs. CDNA is compute-oriented by virtue of incorporating fewer graphics bits, explained industry watcher Patrick Moorhead, president of Moor Insights & Strategy.

In this way, AMD is mounting an effort to compete with Nvidia’s leadership in data center GPUs. CDNA is compute-oriented by virtue of incorporating fewer graphics bits, explained industry watcher Patrick Moorhead, president of Moor Insights & Strategy.

“This is a good move as data center GPUs don't need many of the features a consumer graphics card needs,” Moorhead said. “This includes elements like display and pixel rendering engines, and ray tracing. This means AMD can save cost by removing those elements and add more gates that help data center performance, like tensor OPS.”

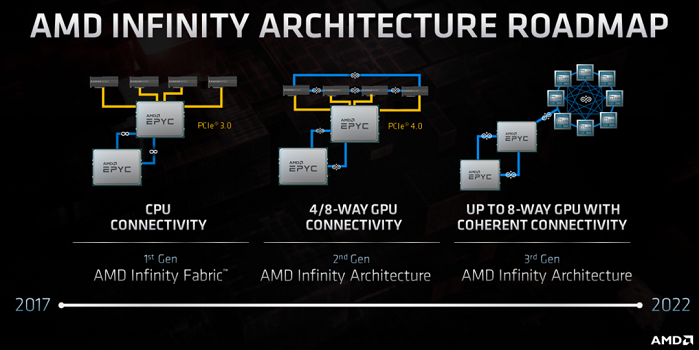

AMD said CDNA will be released later this year, followed in 2022 by CDNA2, which will incorporate AMD’s third-gen Infinity fabric that will play a major role in the El Capitan exascale system the company is building with HPE for Lawrence Livermore National Laboratory, announced this week. The Infinity memory coherent architecture will provide a low latency connection between the four Radeon Instinct GPUs and one AMD EPYC “Genoa” CPU to be included in each node of El Capitan, according to AMD. It will also incorporate unified memory across the CPU and GPU, designed to ease programmer access to accelerated computing.

“Accelerated systems have now been around for about a decade, but what we have done is we have bolted on accelerators onto a server system architecture that, quite frankly, was created for web scale applications and databases,” said Forrest Norrod, SVP/GM of AMD’s Datacenter and Embedded Solutions Business Group. “So the CPUs and the GPUs are isolated from one another. They don't work well together. And although the performance is there, it's difficult to reach, it's difficult to program effectively applications to fully unlock the performance of a system with this topology… With the CDNA2 architecture, we get something truly special, we extend that Infinity architecture … to couple the CPU and the GPUs together into one unified data view. This not only provides additional performance, more importantly, it allows programmers to stop worrying about the explicit management of data movement.”

“Accelerated systems have now been around for about a decade, but what we have done is we have bolted on accelerators onto a server system architecture that, quite frankly, was created for web scale applications and databases,” said Forrest Norrod, SVP/GM of AMD’s Datacenter and Embedded Solutions Business Group. “So the CPUs and the GPUs are isolated from one another. They don't work well together. And although the performance is there, it's difficult to reach, it's difficult to program effectively applications to fully unlock the performance of a system with this topology… With the CDNA2 architecture, we get something truly special, we extend that Infinity architecture … to couple the CPU and the GPUs together into one unified data view. This not only provides additional performance, more importantly, it allows programmers to stop worrying about the explicit management of data movement.”

On the data center CPU side of the product line, AMD said it will launch its EPYC “Milan” chip by year’s end. Successor to EPYC Rome, the 7nm Milan processor will incorporate the Zen 3 architecture. It in turn will be succeeded by the end of 2022 by the 5nm EPYC Genoa with Zen4 architecture, according to the company. Norrod said Genoa will be used in the El Capitan supercomputer.

He added that while AMD believes Rome achieved 80 percent performance leadership across enterprise, cloud and HPC workloads, the company expects Milan will achieve 100 percent leadership.

Of AMD’s resurgence in the data center market, which began with Epyc “Naples” in 2017, Norrod said AMD’s willingness to announce its product 2017-2020 roadmap – and to deliver on it with “metronomic regularity” – were part of a strategy to gain confidence among OEMs and hyperscalers.

“We knew that to be considered for the data center, much less to be a leader, we had to be not just a provider of high performance components, we had to be a reliable partner,” he said. “Somebody that customers could count on to … always be there with each generation – new products, new innovations, maintaining the value of the investment that they would have to put into any new entrant into the data center….”

“We knew that to be considered for the data center, much less to be a leader, we had to be not just a provider of high performance components, we had to be a reliable partner,” he said. “Somebody that customers could count on to … always be there with each generation – new products, new innovations, maintaining the value of the investment that they would have to put into any new entrant into the data center….”

He called Epyc Rome, launched in 2018, “the highest performing x86 processor ever. And it's not close,” delivering “twice the performance of the competitive (Intel) x86 processor, which enables our customers to in many cases drive 25 to 50 percent lower total cost of ownership for providing the data center services to their internal and external customers.”

He said Epyc chips are now available in 140 server platforms and 150 public cloud instances.

The company also announced plans to expand its chiplet and die stacking capabilities, including new “X3D” packaging that combines chiplets and hybrid 2.5D and 3D die stacking that the company said will deliver more than a 10x increase in bandwidth density.

Looking ahead, AMD CEO Lisa Su said the company’s top financial priority is growth, and Norrod said the company expects to attain a “double digit” data center market share by Q2 of this year. Longer term, the company expects 20 percent CAGR, “a massive uptick over the 14 percent CAGR the past five years,” Moorhead said, adding that “most of that growth will come from datacenter CPUs and GPUs.”

Regarding coronavirus, Su downplayed the potential impact on AMD despite having parts of it supply chain in China, along with Malaysia and Taiwan. “We have taken a number of actions to ensure that we have continuity in that supply chain, and based on what we see today, we're actually back to near normal supply capacity in our supply chain.”

As for product demand, she called it a “fluid situation” but overall “demand has actually been about what we expected for the first quarter,” though with some reductions In China. She said the company is not changing its revenue projection for Q1, about $1.8 billion.