Atos Announces FY 2019 Results

PARIS, Feb. 20, 2020 -- Atos, a global leader in digital transformation, today announces its FY 2019 results.

Elie Girard, CEO, said: “We completed 2019 on a strong note exceeding +2% organic growth in the fourth quarter, led by an acceleration of our performance in Cloud, and in Big Data and Cybersecurity. The dynamic commercial activity throughout the year reflects our ability to drive our clients’ enterprise-wide and end-to-end digital transformation initiatives. We also improved our operational profitability in 2019 and delivered a solid free cash flow exceeding 600 million euros. I am proud of the dedication of the Atos teams in attaining such a performance.

With the acquisition of Syntel and the disengagement from Worldline, completed earlier this month under very favorable conditions, the Group has achieved a first step in repositioning itself towards a pure digital player, while enhancing shareholder return and keeping full financial flexibility. Atos is now ready to move forward to the next step.

2020 will be a year of exciting transformation, with further improvement in business and financial objectives for the year. The Group is moving to an Industry approach, developing and attracting the highest level of expertise in each Industry, reshaping its portfolio of offerings and go-to-market, to serve our customers even better and drive our culture of customer obsession even further.

This transformation initiated in 2020 also aims at addressing the latest and most prominent of our customers’ increasing digital needs, namely their cyber-protection and a step change towards decarbonization. With a renewed financial flexibility, the Group can now contemplate bolt-on acquisitions to support and accelerate this transformation, as demonstrated earlier this year with the acquisition of Maven Wave, a Cloud transformation leader based in North America. I will be delighted to present in further details our ambition and strategy for Atos, defined together with the Board of Directors, at our Analyst Day on April 22nd.”

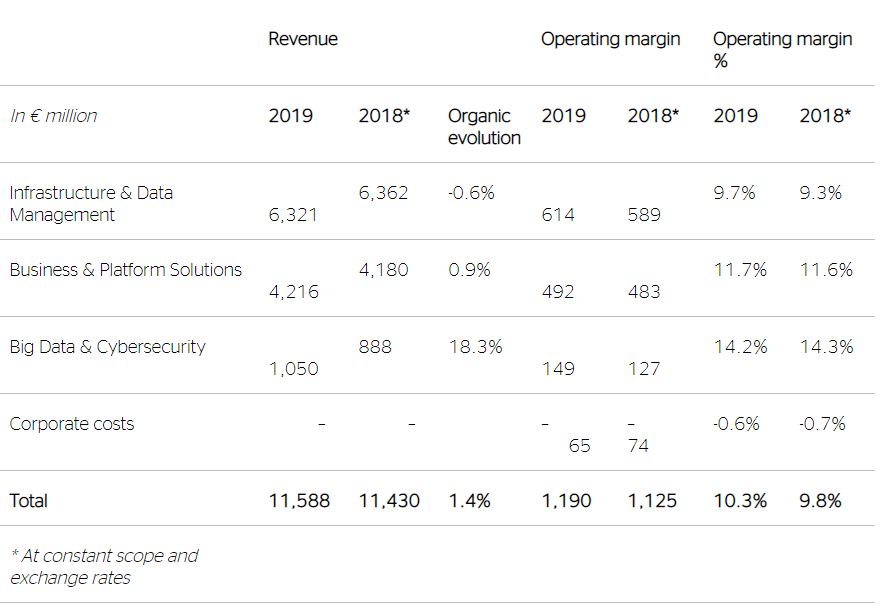

Revenue was € 11,588 million, +1.4% organically, particularly led by the Cloud performance and Big Data & Cybersecurity.

Operating margin was € 1,190 million, representing 10.3% of revenue, compared to 9.8% in 2018 at constant scope and exchange rates. Each Division contributed to the operating margin increase, Infrastructure & Data Management benefitting from automation and the RACE program, Business & Platform Solutions from the cost synergies with Syntel, Big Data & Cybersecurity from the topline growth. Finally, corporate central costs were reduced thanks to continued efforts on expense optimization.

In a year with much less contracts coming for renewal, the commercial dynamism of the Group was particularly high in 2019 with order entry reaching € 12.2 billion, representing a book to bill ratio of 106% compared to 111% in 2018 at constant rate. During the fourth quarter, the book to bill reached 121%.

Net income from continuing operations Group share was € 414 million, and Normalized net income from continuing operations Group share reached € 834 million. Basic and diluted EPS both reached € 3.84 and Normalized basic and diluted EPS both reached € 7.74.

Free cash flow reached € 605 million in 2019, excluding € 37 million of one-off items related to the Optional Exchangeable Bonds (OEB)[3].

Net debt was –€ 1.7 billion at the end of 2019 reflecting the free cash flow generated during the year, the sale of Worldline shares in November 2019, the acquisition of IDnomic during the year, the dividends paid in cash and the share buy-back to deliver performance shares.

2020 objectives

In 2020, the Group targets the following objectives for its 3 key financial criteria:

- Revenue: 2% organic growth

- Operating margin rate: +20bp to 40bp vs 2019

- Free cash flow: € 700 million

2019 performance by Division

Infrastructure & Data Management: Accelerated transition to hybrid cloud and digital workplace

Infrastructure & Data Management revenue was € 6,321 million, down -0.6% at constant scope and exchange rates. The Division managed to turn back to growth in the third quarter 2019 and continued the positive trend, achieving +0.3% organically during the fourth quarter. Thanks to a successful commercial dynamic further to all the actions implemented in the last 18 months, North America pursued its growth in the fourth quarter. The Division pursued its business model transformation by increasing the share of revenue in Hybrid Cloud Orchestration, in Digital Workplace and in Transformation Services projects and continued the digital transformation of its main clients through automation and artificial intelligence.

Regarding FY 2019, Financial Services posted a double-digit growth, mainly fueled by the ramp-up of significant contracts in North America, notably with CNA Financial Corporation, and in the United Kingdom with Aegon, National Savings & Investments and Aviva, which have more than compensated one large contract not renewed in 2018 in North America.

Telcos, Media & Utilities grew thanks to additional sales achieved with BBC in the United Kingdom, new logos notably with National Grid and Entergy Corporation in North America, as well as the ramp-up of the contracts with Scottish Water in the United Kingdom and with a Spanish mobile telco operator. In France, the activity was challenging with businesses not repeated in Utilities compared to Q4 last year. The Industry performed a strong activity in Unified Communication & Collaboration in Benelux & The Nordics and in the Other Business Units while the situation was more challenging in Germany.

Manufacturing, Retail & Transportation slightly stepped back, facing the effects of the non-renewal of a contract with Marriott International in North America in 2018, a strong reduction of activity in Unified Communication & Collaboration in several geographies such as North America and Benelux & The Nordics, as well as volumes reduction and contract ramp downs in Germany. The Industry benefitted from the ramp-up of several contracts signed in North America during the year which partially offset the above effects.

The situation in Public Sector remained challenging, mostly in the United Kingdom impacted by the Transition & Transformation phases completed last year as well as lower volume.

Operating margin in Infrastructure & Data Management was € 614 million, representing 9.7% of revenue. The increase of +40 basis points was mainly driven by strong cost saving actions including the RACE program across geographies as well as the adaptation of the Group workforce in several countries, in particular in Germany which benefited from the effects of the acceleration of the adaptation plan launched in H1. In the United Kingdom, the operating margin was affected in H2 by contractual price constraints in Business Process Outsourcing (BPO).

Business & Platform Solutions: Syntel synergies generated but softness in some industries

Business & Platform Solutions revenue reached € 4,216 million, +0.9% at constant scope and exchange rates in 2019. The activity was contrasted over the year, with a first semester at +2.3% organic growth while the Division was slightly down at -0.5% over the second semester. Indeed, Business & Platform Solutions faced tensions in Financial Services in North America both in Q3 and Q4. The reduction of the number of low margin contracts implemented in H1 2019 at the time of the transfer of contracts under Syntel management impacted the revenue organic growth both in Q3 and Q4. Finally, towards the end of the year, growth was impacted by a slowdown in the Automotive industry in Germany.

Regarding FY 2019, growth was strong in Manufacturing, Retail & Transportation, which benefitted from good performance in almost all geographies. In particular, a solid growth was recorded thanks to the application management services contract with Siemens in Germany, S4HANA engagements in Austria, ramp-up of contracts such as Philips in Benelux & The Nordics, as well as increased volumes in the United Kingdom.

Revenue in Financial Services slightly grew mainly thanks to a contract with a large insurance company in the United Kingdom as well as cloud business with an insurance company in Benelux & The Nordics and ramp-up of contracts in Germany, while the situation remained challenging in France and in North America which was impacted by volume reductions.

The Division posted a slight decrease in Telcos, Media & Utilities. Indeed, higher volumes with Italian and Spanish utilities strongly supported the performance in this Industry while the situation was more challenging in Germany impacted by the ramp-down with one large customer in application management.

The situation was more contrasted in Public & Health which performed an increased activity for digital projects in France as well as new contracts in Italy and in Iberia. Conversely, it faced volume reduction in healthcare in North America due to migrations delivered last year to hospitals which were not repeated as well as project completions in the United Kingdom.

Operating margin was € 492 million, representing 11.7% of revenue, an improvement of +10 basis points. Syntel synergies contributed positively to the Division margin improvement at the level expected. Operating margin improvement achieved in the first semester slowed down in the second half, due to the slow-down of the revenue organic growth of the Division, the ramp down in Germany of a high margin application management contract with one large customer, as well as some cost overruns in Atos legacy contracts.

Big Data & Cybersecurity: Very strong revenue growth in H2 led by a strong demand for High Performance Computing and Cybersecurity services

Revenue in Big Data & Cybersecurity was € 1,050 million, up +18.3% organically, maintaining a strong performance all over the year and pursuing the extension of the Division’s markets both in terms of industries served and geographies.

Big Data activity performed a very high growth, mainly coming from the ramp-up of large contracts in France with notably Météo-France, a French research institute and a Ministry, in Germany with HRLN Supercomputing Service and Forschungszentrum Jülich, in the United Kingdom with the European Centre for Medium Range Weather Forecast, and in Benelux & The Nordics with notably CSC in Finland. It largely compensated for the non-repeated high level of product sales performed last year in North America. Cybersecurity activities were supported by new business opportunities in North America combined with good performance in Benelux & The Nordics which largely offset revenue from licenses not repeated this year in the United Kingdom. The overall performance of the Division was also driven by mission critical systems thanks to solid performance recorded in Central Europe.

Operating margin was € 149 million, representing 14.2% of revenue broadly stable compared to 2018. All in all, the Division generated a solid profitability from operations while continuing to invest in Research & Development and commercial investment on offerings in both Cybersecurity and Big Data solutions. Operating margin was high in growing geographies such as France, Benelux & The Nordics and Other Business Units, while North America benefited from a favorable revenue mix.

For the full financial results, visit: https://atos.net/en/2020/press-release/financial-information-press-releases_2020_02_19/2019-annual-results

[1] Free cash flow at € 642 million including € 37 million of one-off items related to the Optional Exchangeable Bonds.

[2] From continuing operations.

[3] €500 million zero coupon bonds due 2024 exchangeable into Worldline shares issued by Atos on November 6, 2019.

About Atos

Atos is a global leader in digital transformation with c. 110,000 employees in 73 countries and annual revenue of over € 11 billion. European number one in Cloud, Cybersecurity and High-Performance Computing, the Group provides end-to-end Orchestrated Hybrid Cloud, Big Data, Business Applications and Digital Workplace solutions. The Group is the Worldwide Information Technology Partner for the Olympic & Paralympic Games and operates under the brands Atos, Atos|Syntel, and Unify. Atos is a SE (Societas Europaea), listed on the CAC40 Paris stock index.

Source: Atos