At ISC: For the HPC Industry, These Are the Good Old Days

For technology vendors in HPC and HPC-related markets driven by increased demand for AI, enterprise and exascale solutions, this is the best of times – with better times likely in the offing. HPC analyst firm Hyperion Research took the occasion of its semi-annual HPC market update breakfast today at the ISC conference in Frankfurt to announce it has increased its five-year industry forecast to reach $44 billion (€39 billion) in 2023, up from its previous forecast of $39 billion (€35 billion) for that year.

If Hyperion’s projections are borne out, that would put the industry on course to double in size since revenues of $22 billion 2013.

Strong market growth overlays an industry in ferment as vendors scramble to meet the insatiable demand for faster HPDA (high performance data analytics, including AI/ML/DL). It’s a market characterized by rapid emergence of new server processing architectures (CPUs – including those not from Intel, GPUs – including those not from Nvidia, ARM, FPGAs, AI-specific silicon such as neuromorphic chips, to cite a few), by accelerating adoption of HPC and HPC-driven AI in the enterprise and by the onset of exascale systems in countries and regions around the world competing in a high stakes exascale race.

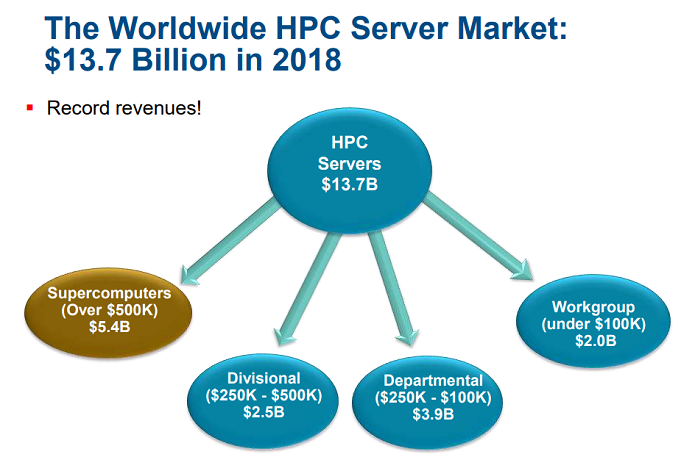

In 2018, the HPC server market grew more than 15 percent to a record $13.7 billion (€12.2 billion) in revenue and is expected to reach $19.9 billion (€17.7 billion) in five years. The supercomputer segment (HPC systems sold for $500,000 or more) is the hottest growth sector, growing 23 percent to $5.4 billion in 2018, according to Hyperion.

HPE maintained its substantial, if somewhat dwindling, lead in HPC servers with a 34.8 percent market share, according to Hyperion, with Dell EMC at a rising 20.8 percent, followed by IBM, also on the rise after the installation of its Summit and Sierra POWER-based supercomputers (currently ranked nos. one and two in the world) at two DOE national laboratories, with 7.1 percent.

Research CEO Earl Joseph said Hyperion’s projected $44 billion revenue figure for the industry in 2023 includes $1.4 billion (€1.2 billion) for exascale supercomputers, $2.7 billion (€2.4 billion) for AI-dedicated HPC servers and about $5.5 billion (€4.9 billion) in cloud usage fees. Joseph said AI will be the fastest-growing HPC segment, with a projected 30 percent CAGR during the 2018-23 period. Also contributing to the 2023 HPC ecosystem forecast: storage $7.8 billion (€6.9 billion); software $8.6 billion (€7.7 billion); and technical support $2.9 billion (€2.6 billion), Joseph said.

As for projected sector growth over the next five years, Joseph said high performance storage growth is expected to cool somewhat to a CAGR of 7.0, ceding the top spot for the first time in several years to HPC servers, which Hyperion expects to grow annually by 7.8 percent between now and 2023, followed by middleware (7.0 percent CAGR), applications (6.7 percent CAGR) and service (5.1 percent CAGR), which Hyperion defines as system maintenance and repair.

Hyperion also provided an update on the global exascale horse race, with the firm expecting China to edge out the United States for installation of the first such system – although both countries are expected to do so within the next 18 months, said Bob Sorensen, Hyperion VP of research and technology, including installation of Intel’s Aurora at Argonne National Laboratory. Hyperion expects global spending on pre-, near- and full-exascale supercomputers will total about $9 billion between 2019 and 2025, including potential for the first $1 billion supercomputer, the Post-K machine at Japan’s RIKEN scientific research institute.

Hyperion also provided an update on the global exascale horse race, with the firm expecting China to edge out the United States for installation of the first such system – although both countries are expected to do so within the next 18 months, said Bob Sorensen, Hyperion VP of research and technology, including installation of Intel’s Aurora at Argonne National Laboratory. Hyperion expects global spending on pre-, near- and full-exascale supercomputers will total about $9 billion between 2019 and 2025, including potential for the first $1 billion supercomputer, the Post-K machine at Japan’s RIKEN scientific research institute.

HPC in public clouds continues to grow, with more than 70 percent of HPC sites running some jobs in public clouds, up from 13 percent eight years ago, and more than 10 percent of all HPC jobs now running in clouds, according to Hyperion. Overall, Hyperion research analyst Alex Norton said, large public clouds are getting better at a broader set of HPC workloads, citing AWS’s utilization of Ryft FPGAs, Google with Nvidia GPUs and Microsoft’s offering of Cray and Bright Computing technologies.

Norton said Hyperion user surveys find that the leading reasons cloud-based HPC is utilized include “bursting” to handle workload surges, isolation of R&D projects, access to specialized hardware and software features or, simply, the lack of an on-prem data center. Hyperion predicts HPC public cloud spending will rise from its current rate of about $3.3 billion to roughly $5.5 billion in 2022.

Norton said Hyperion user surveys find that the leading reasons cloud-based HPC is utilized include “bursting” to handle workload surges, isolation of R&D projects, access to specialized hardware and software features or, simply, the lack of an on-prem data center. Hyperion predicts HPC public cloud spending will rise from its current rate of about $3.3 billion to roughly $5.5 billion in 2022.

Looking ahead, Joseph said the industry will be deeply impacted by:

- The Exascale Race, which is boosting funding for the supercomputing segment and creating broader awareness and interest in HPC; exascale systems are being designed for HPC, AI and HPDA workloads, driving new processor and memory types along with new system designs and new software; and the strategic significance of exascale is driving some countries and regions (i.e., the European Union) to develop indigenous technology initiatives, rather than depend on foreign technology sources.

- Enterprise HPC is broadening and accelerating the market for HPC technology as commercial companies are driven competitively to develop more complex queries against their data and push business operations closer to real time; as companies find increasing value in scalable parallel processing, fast data movement, ultra-large memory systems and other HPC capabilities; and the need for highly data intensive AI/ML/DL workloads for simulation and analytics is in growing demand from both the traditional HPC and commercial sectors.

- Machine Learning growth will outpace that of deep learning due to DL’s lack of “algorithm accountability,” the inability to ascertain how deep learning systems arrived at recommendations, over against ML’s relative transparency.

- Processor Heterogeneity will continue – while the x86 architecture will remain the dominant HPC CPU, indigenous CPUs will gain ground; related to this, ARM-based processors are planned for Europe’s EPI, Japan’s Post-K computer and China ; AI-specific processors for analytics workloads will be launched by startups and established companies; while Nvidia GPUs are the dominant accelerator, three-quarters of respondents to Hyperion surveys say they expect the company to face significant competition in the next four to five years.

- Storage will become increasingly critical due to iterative methods, which will expand volumes of data that need to be stored; future architectures will allow compute and storage to happen throughout the HPC infrastructure; metadata management will handle data stored in multiple locations and environments; distributed, globally shared memory will grow in importance; and storage software will need to become smarter.

- The AI Market, while still early-stage, delivers highly useful capabilities, such as in image and voice recognition (Joseph dismissed the idea of another AI winter); inferencing advances will help reduce training for some tasks, yet as more challenging AI jobs emerge training will continue to grow; AI transparency will improve over time as new tools emerge for gaining visibility into ML/DL recommendations; while ML and DL are the most prominent AI techniques, graph analytics’ ability to handle temporal and spatial relationships will play a crucial role.