More HPC M&A: HPE to Acquire Cray for $1.3B

Venerable supercomputer pioneer Cray Inc. will be acquired by Hewlett Packard Enterprise for $1.3 billion under a definitive agreement announced this morning. The news follows HPE’s acquisition nearly three years ago of supercomputer vendor SGI, for $275 million, both moves bolstering the company’s HPC technology portfolio and, presumably, HPE’s no. 1 position in the HPC server market.

The acquisition joins a recent spate of M&A activity at the advanced scale computing end of the technology industry – including the Nvidia-Mellanox and Xilinx-Solarflare acquisitions, all with the apparent purpose of delivering platforms able to tackle the broad strategic imperatives of the “holy quintet”: integrated HPC-big data-AI-5G-IoT solutions.

"Overall, the infrastructure vendors are all looking to come to market with a more complete story," Henry Baltazar, research VP, infrastructure, at industry analyst firm 451 Research told us in connection with the recent acquisition of Nexenta by high performance storage specialist DDN. This “is why we are seeing storage, networking and other acquisitions taking place. Everybody wants to plug holes either with M&A or partnerships."

The acquisition also underscores Nvidia CEO Jensen Huang’s observation that data centers are increasingly taking on the characteristics of HPC systems. In its announcement, HPE noted that “the explosion of data from artificial intelligence, machine learning and big data analytics and evolving customer needs for data-intensive workloads are driving a significant expansion in HPC.”

HPE cited HPC market research projecting growth from $28 billion in 2018 to $35 billion in 2021. At the highest end of the market are exascale systems, capable of a billion calculations per second, a segment in which Cray is actively involved and which represents an estimated $4 billion market opportunity over the next five years, HPE said.

“This pending deal will bring together HPE, the global HPC market leader, and Cray, whose Shasta architecture is under contract to power America's two fastest supercomputers in 2021," said Steve Conway, SVP of Research, COO and AI/HPDA Lead, Hyperion Research. “The Cray addition will boost HPE's ability to pursue high-end procurements and will speed the combined company's development of next-generation technologies that will benefit HPC and AI-machine learning customers at all price points. Cray will benefit from joining a company with greater resources and much more experience in commercial markets that are increasingly adopting HPC technology to accelerate R&D and business operations.”

Cray technology is foundational to the United States’ exascale roadmap with two exascale-class Shasta systems anticipated to debut in 2021. Cray recently announced a $600 million contract with the U.S. Department of Energy to build the 1.5 exaflops Frontier supercomputer at Oak Ridge National Laboratory, and it is a partner with Intel to build the 1 exaflops Aurora system at Argonne National Lab (with Cray’s portion of the contract valued at more than $100 million). Both systems will support the converged use of analytics, AI, and HPC at extreme scale, using Cray’s new Shasta system architecture, software stack and Slingshot interconnect.

With a heritage extending back to Cray Research, founded by Seymour Cray in 1972, Cray has a leadership position in the top 100 supercomputer installations around the globe and is one of only a handful of companies capable of building these world-class supercomputers. Cray and HPE have a strong presence on the Top500 list, which documents the world’s largest HPC and web-scale systems per the Linpack benchmark. Together the companies claim nearly 20 percent of the total system share (Cray with 49 machines and HPE with 46).

With a heritage extending back to Cray Research, founded by Seymour Cray in 1972, Cray has a leadership position in the top 100 supercomputer installations around the globe and is one of only a handful of companies capable of building these world-class supercomputers. Cray and HPE have a strong presence on the Top500 list, which documents the world’s largest HPC and web-scale systems per the Linpack benchmark. Together the companies claim nearly 20 percent of the total system share (Cray with 49 machines and HPE with 46).

Cray is headquartered in Seattle and has additional engineering and manufacturing facilities in California, Minnesota, Texas, Wisconsin and the United Kingdom. With a workforce of 1,300 employees globally, Cray reported revenue of $456 million in its most recent fiscal year, up 16 percent year over year.

In discussing the company’s first-quarter earnings last week (May 7), CEO Pete Ungaro characterized 2019 as a transition year. “We do not plan to begin shipping Shasta systems until the end of the year; however, with growing momentum and continued execution, we are well positioned to expand on our market leadership position and deliver strong long-term growth.”

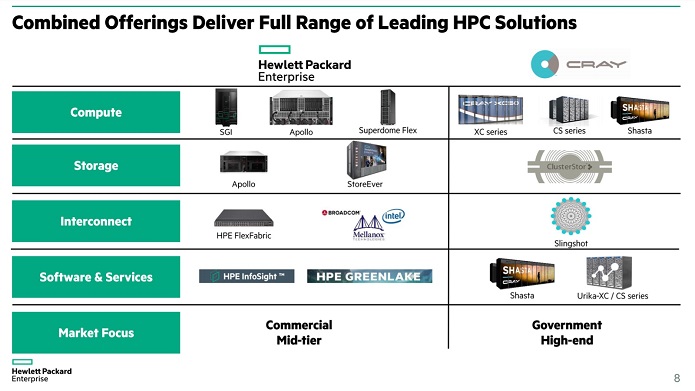

In a briefing with financial analysts this morning, HPE President and CEO Antonio Neri said Cray’s and HPE's product portfolio complement each other, and that HPE foresees Cray products having broader appeal among HPC market sectors.

“What Cray brings to us is what I call the foundational technologies, the next generation of interconnect and software tool chains, which are really critical to managing data-intensive workloads, which are exploding,” said Neri. “They (Cray) are on the 8th gen of this [networking] technology, which is very modular. The reality is it can be applied to the high performance computing aspects of the market, and because it's modular we can take it down to those workloads below the supercomputing (level) that may need these types of characteristics: low latency, high performance and that are Ethernet-based. So this next gen of technology is Ethernet based, which is where the work is going.”

HPE said that as part of the transaction, the company expects to incur one-time integration costs that will be absorbed within HPE’s FY20 free cash flow outlook of $1.9 billion to $2.1 billion that remains unchanged. The transaction is expected to close by the first quarter of HPE’s fiscal year 2020, subject to regulatory approvals and other customary closing conditions.

Ungaro said the acquisition “brings together Cray’s leading-edge technology and HPE’s wide reach and deep product portfolio, providing customers of all sizes with integrated solutions and unique supercomputing technology to address the full spectrum of their data-intensive needs. HPE and Cray share a commitment to customer-centric innovation and a vision to create the global leader for the future of high performance computing and AI.”