AI and Enterprise Data Centers Boost HPC Server Revenues Past Expectations – Hyperion

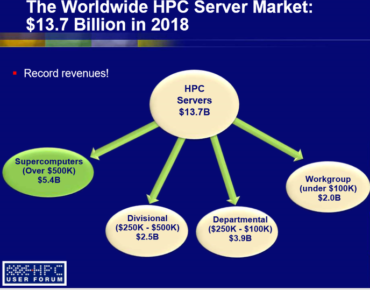

Building on the big year of 2017 and spurred in part by the convergence of AI and HPC, global revenue for high performance servers jumped 15.6 percent last year, according to market analyst firm Hyperion Research, from $11.9 billion to $13.7 billion, exceeding Hyperion’s forecast of $13 billion for the year.

In Q4 2018, high-end server revenue grew by 10.1 percent to $3.7 billion, up from $3.5 billion for the same period of 2017, benefitting "from HPC's crucial role at the forefront of AI research and from the growing adoption of HPC servers by enterprise data centers to accelerate business operations," said Steve Conway, Hyperion’s SVP of research. Looking ahead, the St. Paul, MN-based firm forecasts HPC server revenue will reach $20 billion by 2023, a 7.8 percent CAGR over the next five years.

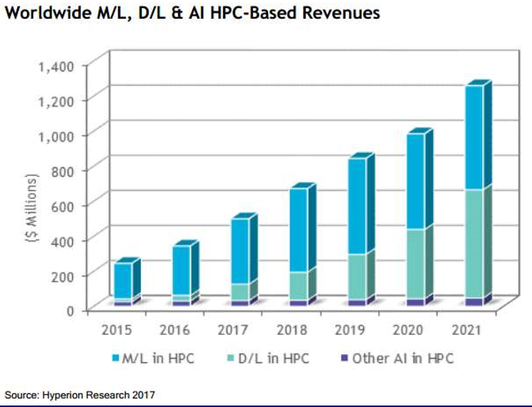

Hyperion expects healthy worldwide HPC-based revenue expansion in machine learning, deep learning and AI, growing from just more than $200 million in 2015 to more than $600 million last year to slightly more than $1.2 billion in 2021; for the 2017-2022 period, Hyperion predicts a CAGR for worldwide HPC-based AI revenues of 26.3 percent; for HPDA: 14.9 percent.

For the broader HPC technology industry, storage sales totaled $5.5 billion, followed by applications $4.6 billion, services at $2.2 billion and middleware at $1.6 billion for a total of $27.7 billion. For the 2018-2023 period, Hyperion said it expects the sector to grow at an annual CAGR of 7.2 percent.

For the broader HPC technology industry, storage sales totaled $5.5 billion, followed by applications $4.6 billion, services at $2.2 billion and middleware at $1.6 billion for a total of $27.7 billion. For the 2018-2023 period, Hyperion said it expects the sector to grow at an annual CAGR of 7.2 percent.

"Fourth-quarter and calendar-year 2018 HPC server revenue grew even faster than we forecast, helped by a robust U.S. and global economy," said Earl Joseph, CEO of Hyperion Research. "We predict continued healthy growth through 2023, with some banner years for the supercomputers segment as pre-exascale and exascale supercomputers are deployed across the world."

Highlights from Hyperion’s “Worldwide High-Performance Technical Server QView”:

• Leading the YoY Q4 growth was the supercomputers segment – specifically, HPC systems sold for $500,000 and up. Revenue in this segment climbed 31 percent to $1.6 billion, compared with $1.2 billion in the prior-year fourth quarter, and accounted for 41.9 percent of Q4 2018 revenue.

• The divisional segment for systems, priced at between $250,000 and $499,000, grew by 12.9 percent, from $587 million in Q4 2017 fourth quarter to $662 million Q4 2018, accounting for 17.8 percent of revenue.

• The market segment for systems sold for $100,000 to $249,000 declined by 6.4 percent in the Q4 2018 to $1.0 billion from the strong 2017 fourth-quarter total of $1.1 billion. The 2018 figure represented 27 percent of fourth-quarter HPC server revenue.

• Similarly, the workgroup segment, systems sold for under $100,000, dipped 18.7 percent, from $607 million in Q4 2017 to $493 million in Q4 quarter 2018, representing 13.3 percent of HPC server revenue.

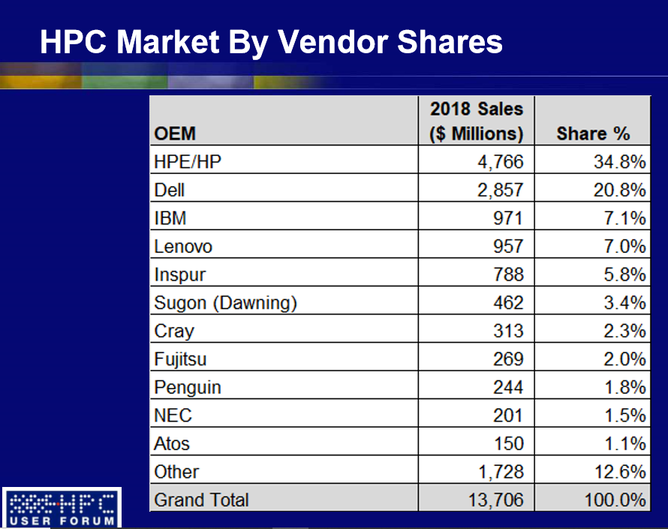

The top four high end server vendors, by market share, for 2018 were HPE with 34.8 percent, Dell EMC with 20.8 percent, IBM (maker of the world’s two most power systems, Summit and Sierra) with 7.1 percent and Lenovo with 7 percent, according to Hyperion. This signifies a significant step forward for Big Blue, which, since the sale of its X86-based server business to Lenovo in 2014, had not cracked the top four in HPC server sales. For the year IBM server revenues in this sector jumped from $575 million in 2017 to $971 million last year.

The top four high end server vendors, by market share, for 2018 were HPE with 34.8 percent, Dell EMC with 20.8 percent, IBM (maker of the world’s two most power systems, Summit and Sierra) with 7.1 percent and Lenovo with 7 percent, according to Hyperion. This signifies a significant step forward for Big Blue, which, since the sale of its X86-based server business to Lenovo in 2014, had not cracked the top four in HPC server sales. For the year IBM server revenues in this sector jumped from $575 million in 2017 to $971 million last year.

Meanwhile, the largest YoY Q4 market share gainers were Penguin Computing (58 percent), Fujitsu, (33 percent) and Dell EMC (27 percent).

As for HPC systems market sectors, bio-sciences led the way at $1.2 billion followed by CAE, chemical engineering, digital content creation and distribution, and economics/financial.