Future View of HPC on Wall Street: Machine-Time Analytics

via Shutterstock

We’ve all heard futuristic debates about artificial intelligence that are, by turn, alarming or optimistic. One side portrays a dystopian, tech-noir world where machines have grown so smart and so fast that we become relatively unintelligent, obsolete and unemployed. Not to worry, counter AI advocates, the alarmists don’t understand the true role of AI as a “recommendation engine” that augments, rather than replaces, human decision-making. The debate has raged for decades, but it won’t be until machine intelligence becomes significantly more powerful in the years to come that we’ll know which view of AI is correct.

Except on Wall Street. There, we already know the answer: machines have taken over.

Wall Street is hooked on speed, and capital markets companies turned their businesses over to machines some years ago. Brokers “roaring like beasts on the floor of the Bourse” is mostly a thing of the past. Trading is done by robots, FPGA-driven high-frequency trading systems that decide and execute transactions at machine-time speeds dwarfing the comparatively puny abilities of people.

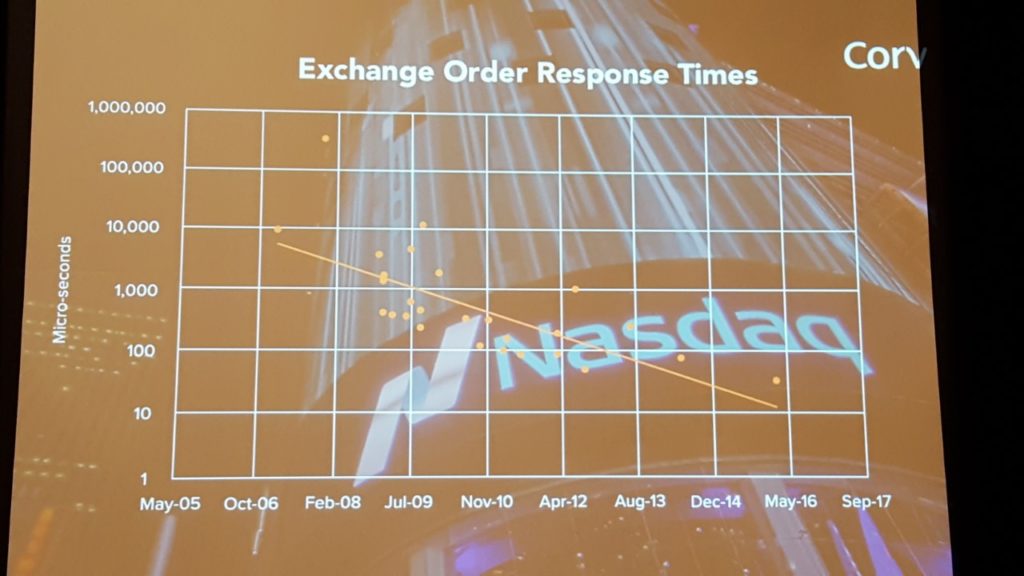

“Machines are actually making decisions in sub-10 microseconds now…,” said Donal Byrne, CEO of Corvil, at the recent HPC for Wall Street conference in New York, “so that means a machine can make a decision on the order of a million times faster than we can as humans. We’ve seen this movie play out over the last five years.”

When you turn your business over to a machine, Byrne said, the first thing that happens is “everything becomes a blur. You just can’t tell what’s happening. It just becomes too much, much harder to understand what’s going on.”

With HFT machines operating at volumes and speeds beyond human’s ability to track, there has emerged a new problem straight out of the alarmist’s view of AI: the need for machines to monitor machines.

The solution, Byrne contended, is what he calls “machine-time analytics,” a new way for humans to make sense of machine decisions and actions occurring at these machine timescales. Machine-time analytics is the ability to analyze the actions and decision of machines at the timescale and granularity with which they act.

Corvil has developed a “streaming analytics platform” that uses network data to track orders and ticks across hops for equities, options, derivatives and fixed income. Used by financial services companies around the world, the platform captures 350 trillion messages per day with a transaction value of more than $1 trillion, according to the company, with each message time-stamped to the nano-second, synchronized and stored. The platform delivers “execution intelligence” – insights into the operational performance of HFT systems – while supporting regulatory compliance by generating detailed trading action data, and supporting cybersecurity strategies.

“The ability to provide performance and a predictability of outcome becomes really critical to the success of the business,” Byrne said, “but the big problem is that an infrastructure mishap has a disproportionate impact on the business. It happens in a way that it really disrupts the business. We’ve all seen examples… This gets to the board, and the board asks: What’s happening here? How are we protected from the risk of mishap? How are we protected from the risk of cyber attack in a machine world?”

Taking on the problem requires a shift in thinking about the nature of time – we need to appreciate the magnitude of machine-time, which is the amount of time it takes for a machine to make a decision. Whereas we think of real-time as immediate, Byrne said a human-scale notion of real time no longer applies to a world operating at machine-time speed.

“This changes everything in the machine era,” Byrne said. “In the world of financial technology and trading, intelligence about speed will become more valuable than speed itself. And in the machine era, the challenge will no longer be speed, it will be time. Those who can tell time more accurately and have more analytics about time will have a competitive advantage.”

Put another way, we need to understand time in terms that are “relevant to the action at hand. … When we talk about machine-time analytics, the fundamental premise is…the ability to continuously monitor, analyze, track and forensically verify the precise time sequence that all machine actions, and events that led to the action … You need to have the (transactional) data and you need to have the time (at which transactions happened). And from it you can derive really interesting analytics.”

Machine-time analytics rests on four pillars, Byrne said.

First: a trusted source of detailed data. “If the data is of poor quality, if it’s summarized, or if it’s the wrong data, then you’re going to get garbage out.” Byrne contends that network data is the best source to tap into because it captures all trading activity.

Second: an accurate view of time, which means that all trading actions are time-stamped to an exacting degree.

Third: the application of advanced machine learning algorithms to analyze trading activity. Here, Byrne said, more work needs to be done. “I will tell you from our experience that Wall Street doesn’t like guesswork. From what we’ve seen, 99 percent of the learning algorithms out there will not cut it on Wall Street. This isn’t to say it has to be precisely deterministic, but it has to give you 99.99 percent confidence. It’s a totally different ballgame.”

Fourth: continuous, streaming tracking of all activity on the trading platform.

“There’s a new player around the corner: The ‘machine-time trader’,” Byrne said. “And it’s not just an algorithm running on a fast machine. This is a machine that can consume zetabytes of data, do analysis on the fly, apply AI, cognitive computing, machine learning, consume just vast amounts of information to produce a decision to trade. You thought high frequency trading was disruptive? It’s nothing compared to what’s happening here.”

Another new phenomenon in the offing: the “high frequency hacker.”

“We talk about the machine-time trader,” Byrne said, “we’ll be talking about the machine-time hacker as well. We have to have machines that watch over our machines that protect us from that development.”