Autonomous Cars: Google No. 1, Toyota Sees Carbon-free Future, Memory a Speed Bump?

With billions of dollars at stake in the car market of the future, technology and auto companies are aggressively jockeying for position to deliver self-driving vehicles that could, ultimately, produce no greenhouse gas emissions

Regarding autonomous vehicles, projected to be a nearly $5 billion market by 2025 (McKinsey & Co.), industry analyst Richard Windsor of Edison Investment Research came out with scathing statements on Uber’s development efforts. Windsor's take on the relative robustness of ADAS's (Advanced Driver Assisted Systems) is based on “disengagement” research from the California Division of Motor Vehicles showing how often drivers have to take over operation of the car to correct shortcoming in the autonomous driving software.

This, according to Windsor, is “the best measure of an autonomous driving solution,” and the California DMV data puts Waymo (Google) in the top position with one disengagement every 5,128 miles, which is eight times better than no. 2 BMW with one disengagement per 638 miles driven. They are followed, in order, by Nissan, Tesla, Mercedes and Uber, which, Windsor said, the California data shows having one disengagement for each mile driven.

“Google is 5,000x better than Uber at autonomous driving,” Windsor said. “Although Google is suing Uber for the alleged theft of its Lidar (key autonomy sensor) design, it does not seem to have helped Uber much as it appears to be by far the worst at autonomous driving. This is still the case when one includes the regular car companies that most people have written off as having very little to offer in the new world of digital and autonomous cars.”

Windsor added a caveat on the California DMV data, explaining that while the state requires companies that test their autonomous cars in the state to submit disengagement data, “they all submit it in different ways. There are also different types of disengagement such as when the car is going to hit something (critical) or when the safety driver feels uncomfortable (ordinary). Furthermore, companies test their cars in different conditions meaning that the data can really only be used as indication. However, the contrasts are so stark that we think that meaningful conclusions can be drawn about how advanced the autonomous driving solutions from different players really are.”

In an emailed response provided to EnterpriseTech by Uber, the company emphasized that "each company measuring disengagements defines their interventions differently, so they do not make for an accurate apples-to-apples comparison.

"For example, one company's 2015 report states there are thousands of normal, expected takeovers during their rides, but they're not counted," said the Uber spokesperson. "Our MPI (miles per intervention) includes all of those takeovers. Waymo's EOY 2016 report submitted to the DMV refers to 'safety disengagements,' not any kind of disengagement or rider comfort issue (both of which we measure)."

Uber made self-driving car news earlier this week when one of its autonomous vehicles was involved in a crash in Arizona. It was later announced that the Uber vehicle apparently was not responsible for the accident. Uber suspended for three days testing of its autonomous cars before resuming later in the week.

(As an aside, it should be said that California DMV's disengagement statistics would have more value if it imposed the same measurement standards on all participants.)

With artificial intelligence the core technology at the heart of self driving cars, Windsor said, the key to success in this industry “is the amount of time that one has been working on the algorithms as well as the amount of data collected.

“We are certain that this is why Waymo is the best because it began working on autonomous driving in 2009 (far earlier than anyone else) and in the last two years has driven more than 150x more miles than anyone else,” he said.

As for Uber, Windsor said it “currently has the advantage because it has already established itself as the market place for drivers and passengers to transact and these types of positions are extremely hard to disrupt once created. This is why Uber commands the $70bn valuation that it does but unless it gets a handle on autonomous driving, this market place may become obsolete when humans stop driving cars.”

Meanwhile, memory chip maker Micron Technology issued a warning regarding a potential stumbling block to self-driving cars coming to fruition: while most attention is placed on processing, as it currently stands, memory technology is not up to the demands that autonomous cars will create.

Micron’s Barbara Kolbl cited the example of Google’s Waymo, which she said generate about 1 GB/sec.

“The average U.S. driver drives about 600 hours/year,” wrote Kolbl, a Micron strategic marketer, in a blog. “Thus a typical U.S. driver of an autonomous vehicle could generate about 2 PB/car per year. With millions of cars on the road in the U.S. the total amount of data generated is enormous. Memory manufacturers, like Micron, are innovating to meet the next generation requirements, but currently there are no memory solutions in existence that can meet the typical 2 PB/car per year demand, further underscoring the important role that memory will play in enabling the next generation of autonomous driving.”

According to McKinsey & Co., the four “control points” of autonomous vehicle systems are: sensors, mapping, processors (ECUs/MCUs) and software algorithms. Here’s how Kolbl summarized them in action:

“To achieve fully autonomous driving, cars need to have a variety of sensors to perceive near and far fields of visions in every direction. The sensors include radar, LIDAR, ultrasonic, cameras, and night vision devices. The data collected by these sensors are fed into highly complex System on Chips (SoCs) with compute performance that is equivalent to what only supercomputers could deliver a few years ago. Complex, state of the art algorithms that are increasingly based upon artificial intelligence ensure vehicle, driver, passenger, and pedestrian safety based on factors such as traffic, weather, dangerous conditions, etc.”

Kolbl contends that while “most of the innovation and focus is on the processors and optical semiconductors…all four control points in ADAS (advanced driver assistance systems)…are directly affected by memory bandwidth, latency and throughput.”

On the emissions front, Toyota Research Institute (TRI) announced a major AI/machine learning push in the area of advanced materials (batteries, fuel cells) while setting for the world’s largest automaker the goal of developing, over the next several decades, vehicles that have zero-emissions and are carbon-neutral.

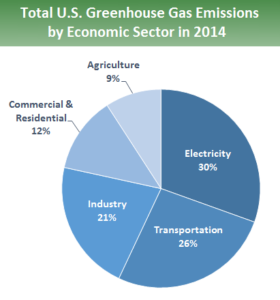

More than 90 percent of the fuel used for transportation (cars, trucks, trains, ships, planes) is petroleum-based (gasoline and diesel), and those vehicles account for 26 percent of annual U.S. greenhouse gas emissions, as of 2014, according to the U.S. EPA. (Note that electrical consumption is the biggest emitter of greenhouse gasses, of which data centres comprise 2 percent.)

TRI announced today it will collaborate with research groups, universities and companies on materials science research, investing approximately $35 million over the next four yearsThe program’s goal is to “revolutionize” materials science and identify new advanced battery materials and fuel cell catalysts. The institute said its ultimate objective is to cut the time required for new materials development, which is typically measured in decades

"Toyota recognizes that artificial intelligence is a vital basic technology that can be leveraged across a range of industries, and we are proud to use it to expand the boundaries of materials science," said TRI Chief Science Officer Eric Krotkov. "Accelerating the pace of materials discovery will help lay the groundwork for the future of clean energy and bring us even closer to achieving Toyota's vision of reducing global average new-vehicle CO2 emissions by 90 percent by 2050."

Research projects include collaborations with Stanford University, the Massachusetts Institute of Technology, the University of Michigan, the University at Buffalo, the University of Connecticut and the U.K.-based materials science company Ilika. TRI said it is in discussions with other research partners.