IT Heavyweights Open Wallets to Acquire IoT Startups

As the number of acquisitions by the likes of Google, Intel and Cisco continues to grow, a market researcher found that building-block cloud, networking and datacenter technologies are helping to flesh out the emerging Internet of Things (IoT).

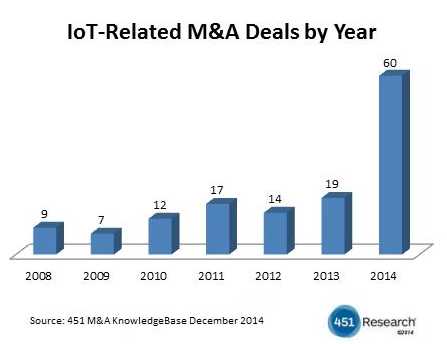

Market watcher 451 Research reported on January 6 that IoT-related mergers and acquisitions were north of $14 billion in 2014 as more than 60 companies were snapped up by Google, Samsung, Intel, Cisco, Qualcomm and others. The spending spree represented an eight-fold increase in IoT-related mergers and acquisitions over the previous year, 451 Research estimates.

“The expected growth in this segment will drive enterprise spending across a myriad of building-block categories from embedded computing systems to communication infrastructure, IP networking, cloud and datacenter technologies that will form the foundation of the next generation of connected machines and services," said Brian Partridge, vice president of 451 Research’s mobility team.

"We expect to see even more activity in 2015 as the cost and risk hurdles to IoT adoption are overcome and the competition to serve these markets increases," Partridge added. The researcher also predicts that IT infrastructure and services providers have a major stake in the unfolding IoT market.

Whether it's "Internet of Things" or "Internet of Everything," IT infrastructure giants like Cisco and Intel have been pouring resources into all-encompassing networks that link sensors, machines and mobile devices, thereby generating massive volumes of new data that needs to be stored and analyzed.

"It's about connecting everything," Cisco CEO John Chambers declared in December as the networking giant laid out its Internet of Things/Everything strategy that seeks differentiate it offerings from others entering the connected device market.

Cisco estimates that IoE could be a $19 trillion opportunity. Of that, the capabilities needed to capture and leverage data from sensors and devices could amount to as much as $7.3 trillion, Chambers predicted.

Other IT vendors have announced similar strategies. For example, chip giant Intel Corp. unveiled its IoT platform last month that is based on what Doug Davis, general manager of Intel’s IoT initiative, called a “repeatable foundation” that will enable the development of connect products and accompanying data services.

The IT infrastructure strategies and bullish IoT forecasts are based on predictions that something on the order of 40 billion sensors and 10 billion devices will be connected by 2020, according to an Intel estimate. The chipmaker claims it has already wracked up $2 billion in revenues over the past year from its nascent IoT business.

The scramble to define IoT strategies has fed the current M&A frenzy. According to 451 Research, mergers and acquisitions have been evenly divided among "IoT-enabling horizontal infrastructure and vertical applications."

The majority of acquisitions focused on sensors, semiconductors, software platforms, security infrastructure and connectivity technologies, the market researcher said. Among the market segments attracting buyers were transport and logistics (11 deals) and fitness and health care (10 transactions).

The smart products manufacturing specialist PTC made several high profile IoT acquisitions in 2014 that could position it to compete in the emerging market against traditional enterprise software giants like IBM, Oracle and SAP, 451 Research said. In August, for example, PTC acquired Axeda Corp. for $170 million. Axeda develops technologies used to securely connect machines and sensors to the cloud.

The largest IoT-related deals during 2014 involved home automation startups, including Google's $3.2 billion acquisition of Nest Labs.