AMD Sets “Seattle” ARM Server Chip Launch For Q4

Datacenters that are eager to test out 64-bit ARM server chips with their workloads are going to have to wait a bit longer than they might otherwise like to. Last month, AMD started sampling its "Seattle" chip, the first generation of its Opteron A-Series processors, and the company said this week that it will ship the chip to server customers in the fourth quarter.

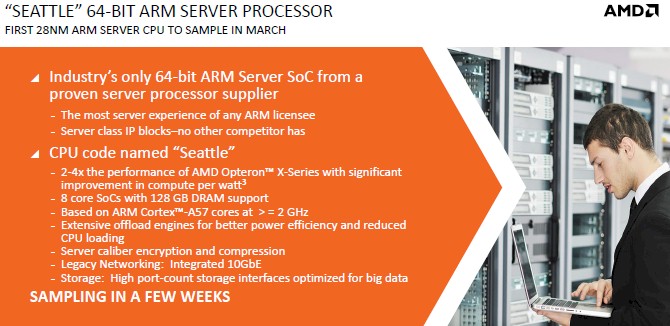

The Opteron A1150 chip, as Seattle will be called, is based on the 64-bit Cortex-A57 core designed by ARM Holdings. It will come with either four or eight cores, with 4 MB of L2 cache and up to 8 MB of L3 cache that is shared across those cores. Interestingly, the chip will have memory controllers that will support both current DDR3 and future DDR4 memory running at speeds up to 1.87 GHz. The chip has four memory slots per socket and the maximum memory on the tweaked Seattle design was doubled up to 128 GB back in January when AMD released some of the feeds and speeds of the processor. The chip will have eight lanes of I/O coming out of its PCI-Express 3.0 controller, dual 10 GB/sec Ethernet ports, and eight SATA3 ports for peripherals (This will allow for each core to be allocated with its own disk drive, an important ratio for Hadoop data analytics).

AMD is staking a lot on enterprises – particularly hyperscale datacenters that control their own software stacks – being interested in an alternative to the X86 architecture for servers.

"We’ve reached a significant milestone in our ambidextrous strategy," explained CEO Rory Read in the conference call. "What we are doing here is identifying this opportunity long before it had taken place. And we are catching it just as the wave is forming. That is the kind of innovation leadership that we really want to go after. This is going to be an important market over the next three to five years, and we have an opportunity to truly lead in this ARM server ecosystem and take advantage of our ambidextrous capability. This is spot-on in the strategy."

As we all know, timing is everything in the IT sector and ARM server chip pioneer Calxeda got out in front of the software ecosystem and burned through its venture capital before it could get to a 64-bit design and shut its doors down in December. One of the key innovations that Calxeda was working on was a distributed Layer 2 switch on the chip that obviated the need for top of rack switches in server clusters. AMD was working on integrating its Freedom 3D torus fabric with the Seattle chips but back in January the company decided to push this feature out to a future Opteron A-Series processor. For now, the Opteron A1150 will link to the outside world through those integrated 10 Gb/sec Ethernet ports on the die.

All that Lisa Su, senior vice president and general manager of the Global Business Units at AMD, would say is that integration with the Freedom fabric was still in the works.

"One of the advantages of having a systems business is that we can do co-development between our chip development and our systems development," Su explained. "So it will be quite important for us to have Seattle and SeaMicro, and that's in development."

What EnterpriseTech was told back in January is that the Freedom fabric integration would come with the next-generation of Opteron A-Series chips, which AMD has not provided any details for as yet.

As you might expect, AMD can't say much about who is taking a look at the Seattle chips for future server designs, be they traditional server makers or hyperscale datacenters who design their own gear and have it made by original design manufacturers.

"I think what we're seeing in Seattle is interest from a number of different angles," explained Su. "I think there is general interest in ARM, there is interest in sort of trying out the new workloads with the capability. I think we see the fabric as an important differentiator, but we see that as a longer-term differentiator in the systems portion of the business. So I think the interest in Seattle is really that it is the first 28-nanometer, 64-bit server chip out in the market. And I think that's driving the customer engagement." As for the revenue potential, neither Su said it was too early to tell what might happen in 2015, but that "interest in the platform was quite high."

Ideally, AMD would like to be able to sell the SeaMicro Freedom fabric ASICs and Opteron X-Series and A-Series processors to customers who wanted to build their own microservers as well as whole machines to customers who want to buy directly from AMD or, in the case of Verizon's Terremark cloud unit, license the SeaMicro hardware and software and create customized versions of the platform tuned to their specific uses. Thus far, AMD has not been able to line up licensees among the tier one and two server makers to use its Freedom interconnect and it may never do so. Hyperscale datacenters are building their own software-defined networks and want open switches with open network operating systems to do so. Smaller cloud players, like Verizon Terremark, have the money and technical chops to start with the basic SeaMicro platform and hack it to suit their needs. Large enterprises would most likely just prefer to go directly to AMD for finished servers.

AMD does not break out SeaMicro server sales separately in its financial reports but the company did say in its Q1 2014 report that SeaMicro revenues were up sequentially from Q4, which is an atypical bump compared to the normal Q1 slump. Read said on the call that this was driven by Verizon's ongoing deployment of SeaMicro gear in its public cloud.

"The dense server market is projected to be approximately 25 percent of the overall server market by 2019," said Read. "We intend to lead this transition with our unique fabric technology and 64-bit processors."

In a separate development, AMD was showing off the "Berlin" Opteron X-Series ceepie-geepie chip, which marries four "Steamroller" X86 cores to a baby Radeon GPU, running the Fedora development release of Red Hat's Linux variant. The demo was done at this week's Red Hat Summit, and also included running Fedora on the Seattle chips mentioned above. The Opteron X2100 was shown running the "Project Sumatra" software stack that AMD is working on with Oracle to allow for parallel sections of Java applications to be offloaded to the on-chip GPU. (EnterpriseTech told you all about the Berlin chips and the Java acceleration plans back in November.) AMD plans to deliver the Berlin chips in the first half of this year.

In the quarter, AMD's Computing Solutions unit, which includes processors and chipsets for all manner of computing devices as well as the SeaMicro servers, posted sales of $663 million, down 11.7 percent, and had an operating loss of $3 million. AMD said that the drop in sales were due to declines in sales of processors for client devices. Chip average selling prices were down slightly year-on-year across client and server chips lumped together. AMD has not provided much insight into its Opteron server chip business for many quarters, and it has not provided a roadmap for future Opteron processors, either.

The company's Graphics and Visual Solutions unit made up the shortfall in processor revenues, with sales up 156 percent to $734 million thanks in part to the game console business AMD does with Sony and Microsoft and in part to the success of the latest Radeon graphics cards for PCs. The graphics unit had an operating income of $91 million.

All told, AMD had a smidgen under $1.4 billion in sales and an operating income of $49 million. AMD posted a net loss of $20 million after taxes and other costs, which is a far cry better than the $146 million loss it had in the prior year's first quarter. AMD ended the quarter with $982 million in cash and equivalents, which is close to the $1 billion it likes to keep in the bank for emergencies. The company has $2.14 billion in total debt.