IBM Throws Power8 Gauntlet At The Feet Of X86

The systems business at IBM continued to stall in the first quarter thanks to product transitions in the Power Systems line, the System x business being sold off to Lenovo and causing many customers to pause their buying, and the System z mainframe being about a year away from a refresh. And it does not look like the other three quarters of 2014 are going to be much fun for the Systems and Technology Group at Big Blue, either.

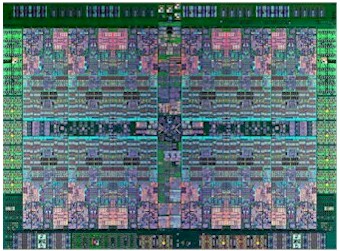

But IBM is positioning Power8 processors to do battle with X86 machinery in the datacenter and said repeatedly when discussing its current financial results that it was in it for the long haul with Power Systems.

As EnterpriseTech has already revealed, IBM is getting ready to launch Power8-based systems at the end of this month and will be starting at the low-end with scale-out systems to bring the fight to Intel's Xeon E5 and E7 machines. Martin Schroeter, IBM's chief financial officer, did not elaborate on the impending Power8 system announcements but he did throw down the gauntlet on a call with Wall Street analysts to go over the results for the first quarter.

"The secular move from Power to X86 servers – we will battle back with Power8 and a much better offering in that space," Schroeter said.

The Power Systems division had too many people in it based on the current and expected revenue stream, hence the layoffs that IBM did in the first quarter (The exact number IBM has not divulged, and it will not do so, either).

Moreover, IBM has put together the OpenPower Foundation, a consortium of hardware and software partners to try to build an ecosystem around Power8 and future Power chips, including allowing companies to license the chip and manufacture variants of them akin to the method that ARM Holdings has used to propel its ARM designs into myriad consumer devices and, soon, servers and storage.

IBM is particularly keen on promoting Linux on Power and Schroeter said that there are now over 800 independent software vendors whose wares are certified to run on the Power-Linux combo. Many of the hyperscale and extreme scale customers that IBM would love to sell Power-based machines to have their own variants of Linux, as well as their own applications, so they can relatively easily port their code to Power should it make sense for performance reasons. This is, in fact, the bet that Big Blue is making. It may not be as bold as the bet the company made to create the System/360 mainframe 50 years ago but the company is not walking away and remains committed to using Power machinery behind its Watson service and continuing to design processors for both Power and System z platforms into the future.

All that said, Schroeter conceded that there will continue to be challenges, even with OpenPower building some momentum and Power8 systems in the field soon.

"Power is not going to turn around right away, and in fact I think 2014 is going to be a difficult year for Power if you look at year-to-year revenue growth," he said on the call. "But we are absolutely taking the right actions to make that Power platform a sustainable and a highly attractive economic model for us. We have taken cost out and we are getting the right technology and ecosystem around it to make sure it has a long-term future."

On a broader scale, the declines across servers, storage, and we presume switching (which IBM does not call out separately in its financial reports and bundles in with servers) that the company reported for the first quarter of 2014 would be stunning in their magnitude had Wall Street not seen them already in recent quarters.

The 40 percent decline in System z mainframe sales were expected based on this point in the mainframe product cycle, Schroeter said. The current System z12 line of machines is six quarters into its three-year cycle and customers are generally not buying new machines but activating latent cores in existing machines utility-style. This business is extremely profitable for IBM, and in fact, mainframe margins are considerably higher this quarter because of this. IBM is not expected to launch a new System z13 mainframe until year, so it will be more of the same as 2014 progresses. The important thing, Schroeter said, was that if you look at the amount of capacity sold at this point in the z12 cycle (as gauged in MIPS) and compare it to the same point in the z11 cycle, the MIPS in the base is 26 percent higher even though MIPS shipped in Q1 was down 19 percent. IBM charges for its mainframe systems software – and is the sole supplier of operating systems and most of the other systems software on the machines – based on processing capacity, so the expanding capacity may not generate a huge amount of hardware dollars but it does generate a recurring stream of software dollars.

Very few system businesses have been able to build such a recurring revenue stream in the five decades of the modern IT era. No other IBM server divisions have either, although, Big Blue has certainly tried with the Power Systems business that is based on its own Power processors and systems and its own AIX and IBM i (formerly OS/400) operating systems as well as Linuxes from Red Hat, SUSE Linux, and soon Canonical, as EnterpriseTech has previously reported. While the Power platform generated big hardware bucks for many years, on the AIX platforms databases and middleware from Oracle and others drove that hardware sale, and both AIX and IBM i are sold with perpetual licenses rather than with monthly fees like mainframe software – and for a lot less money, too, per unit of processing capacity. And on System x X86-based systems, the operating systems come from Microsoft, Red Hat, and SUSE Linux and a lot of the other systems software comes from third parties. Couple that with razor-thin margins on X86 server hardware and discounting to win deals in the channel and it is no wonder IBM wants to fall back and only sell profitable systems where it controls more of the stack.

In the quarter, Power Systems sales were down 22 percent and System x sales were down 18 percent. Hewlett-Packard, Dell, and others are no doubt playing up the uncertainty and doubt caused by the Lenovo deal, much as they did when the Chinese company bought Big Blue's PC business a decade ago. This is the easy time for them to make some competitive sales. It will get tougher for HP, Dell, and others should IBM and Lenovo prevail in finishing their $2.3 billion deal and Lenovo brings its own supply chain and low-cost manufacturing to bear in the X86 server space.

Add it all up and IBM's System and Technology Group posted $2.39 billion in sales, down 23 percent and its pretax loss increased by 63.1 percent to $660 million. Much of that loss was due to the workforce reductions that IBM took in the first quarter, which added up to an $870 million in total charges. IBM said that Global Services took a $600 million charge for layoffs, with Software Group taking $200 million and Systems and Technology taking another $200 million (These numbers were rounded to the nearest significant digit, irritatingly, and do not add up to $870 million but should). Servers (presumably with switches tossed in) accounted for $1.58 billion in revenues, while storage brought in $502 million. IBM Microelectronics brought in only $311 million in sales having lost most of the game console business to AMD.

IBM's Global Services unit booked $14.1 billion in revenues, down 2 percent year-on-year. IBM's total services backlog stood a $138 billion, which was up a point after taking out a $3.8 billion backlog from a divested customer care business, which it sold off late last year. IBM does not break out its cloud revenues directly but said they had grown by 50 percent and added that its "cloud delivered as a service" business now has an annual run rate of $2.3 billion, double from last year. Some of that is from the SoftLayer infrastructure and platform cloud it acquired last year but there has to be a lot of other components to this cloud revenue beyond SoftLayer. Pre-tax income for the services behemoth fell by 13.7 percent to $1.97 billion. If it had not been for the write-offs from the layoffs, Global Services would have probably shown significant pre-tax income growth in the quarter but IBM is positioning for the rest of 2014 and beyond.

Software Group had $5.66 billion in sales and has absolutely been impacted to some degree by the decline in Power Systems and System x sales because new machines get new operating systems for the most part. Pre-tax income for IBM's software business declined by 4.7 percent to $1.92 billion.

Add it all up, IBM had $22.38 billion in sales, down 3.8 percent, marking the ninth quarter straight of revenue declines. Pre-tax income was $3.83 billion across the whole company, down 13.7 percent, and net income dropped 21.4 percent to $2.38 billion. IBM has been very clear for more than two decades that it would divest itself of low-margin businesses and move to higher ground and higher profits. But Wall Street still likes to see revenue growth and does not like to see revenue declines, even if it does position IBM for future and larger profits down the road.