Hyperscale Datacenters To Dominate Server Shipments

The cloud, in its many forms, is changing the nature of servers and storage and is therefore transforming the overall market for systems and storage. Nothing makes this more clear than the quarterly server data coming out of IDC, which has begun to track density-optimized systems and machines made by original design manufacturers separately from the enterprise-class rack and tower servers made by the tier one suppliers.

In the second half of last year, Google did a massive server build out in excess of 100,000 units, Jed Scaramella, research director for enterprise servers at IDC, tells EnterpriseTech, and that boosted the numbers for ODM iron. Scaramella also said that there is no company that is actually building its own servers at this point and that, in fact, all of the major hyperscale datacenters that are keenly involved in the design of their machines are nonetheless using third parties to do most of the manufacturing. These web application providers and cloud service providers may negotiate component purchases on their own, even going so far as to get specialized chips from vendors like Intel and AMD, but they do not have server assembly lines next to their datacenters.

Quanta Computer is biggest of these ODMs, and has been quite clear that it thinks this part of the market can grow from about 20 percent of server shipments in 2013 to around 40 percent of shipments in the next three years, as Mike Yang, general manager of the Quanta QCT cloud unit, recently told EnterpriseTech. Scaramella concurs that, if you only include the largest hyperscale operators and cloud service operators, then they account for about 20 percent of shipments these days. IDC's projection is for the ODMs to account for about 40 percent of server shipments in the next five years, not for the shorter three-year term that Quanta is projecting.

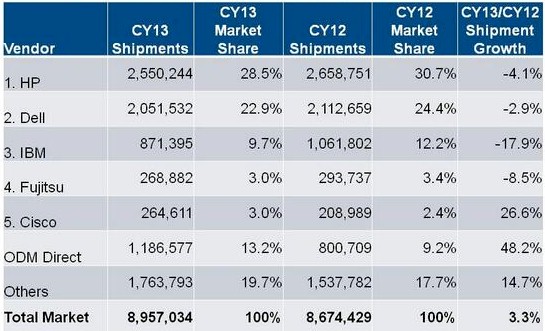

Here is how server shipments stacked up by vendor for 2013, with the ODMs all lumped into one:

It would be simple to conclude form the data above that Cisco Systems and the ODMs are eating share from Hewlett-Packard, Dell, and IBM. But the situation is more complex. Hyperscale companies that used to buy from HP and Dell have shifted to ODMs to save money, and HP and Dell have taken market share away from IBM in the enterprise. Cisco is getting greenfield installations for clouds, virtual desktop infrastructure, SAP HANA, and other new workloads that might have otherwise gone to its tier one rivals. And the ODMs, having got a good grip on the hyperscale datacenter operators, are now expanding into cloud service providers and enterprises, ever so slowly – thanks in part to the Open Compute Project launched by Facebook nearly three years ago.

One interesting thing about the server market today is that you can't necessarily correlate the use of density optimized and modular servers with the hyperscale datacenter operators and cloud service providers – a conclusion that many might jump to. "Most of the servers in the hyperscale market – on the order of 70 percent of shipments – are still rack-based," says Scaramella. And that hyperscale segment is for the very top buyers of machines, not every single company that has gear that is not inside a datacenter of a traditional enterprise customer.

"The one thing that is getting challenging is telling the difference between servers and storage," Scaramella says with a laugh. "Is a box with a bunch of disks in it but a modestly powered Atom or ARM processor a server or a storage array?"

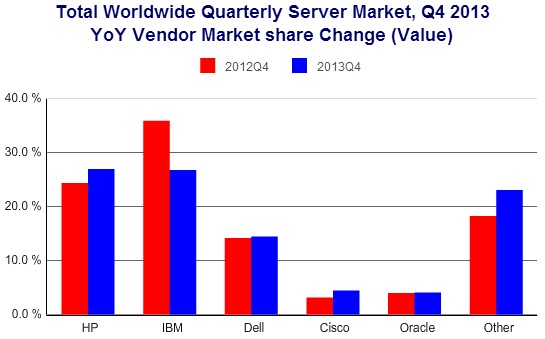

For the fourth quarter of last year, IDC reckons that overall server revenue dropped by 4.4 percent to $14.24 billion, with shipments increasing 8.2 percent to 2.5 million machines. Servers that ended up with a Linux operating system installed on them rose by 14.4 percent to $4.1 billion in sales, aided by large cloud build outs where Linux is the underlying operating system no matter what operating systems are running inside of virtual machines. Windows Server is still the dominant operating system shipped on machines, with $6.5 billion in sales in the fourth quarter, but rising only one-tenth of a percent. Unix systems only accounted for $1.9 billion in revenues and fell by 20.2 percent, while IBM's System z mainframes, which hit a peak a year ago, declined by 36.8 percent to $1.1 billion.

During the final quarter of the year, X86 machinery drove $10.7 billion in sales, according to IDC, up 7.8 percent, with shipments of 2.5 million units, up 8.6 percent. By form factor, blade servers accounted $2.4 billion in revenues across all chip architectures, but most blades sold use X86 processors. Density-optimized modular machines drove $1.2 billion in sales, up 70.3 percent, and shipments were 382,000 machines, up 64.6 percent.

For all of 2013, IDC pegs the worldwide server market at $49.7 billion, down 4.4 percent, and shipments increased 3.3 percent to 8.96 million units. (That is a record for annual shipments, by the way.) In the table above, some of the machines sold by the tier one makers end up in hyperscale datacenters to comprise that approximate 20 percent shipment share both Quanta and IDC are talking about.

If you want to just count money – and this is what matters most in the server racket – then HP was the revenue leader for 2013, with $13.24 billion in revenues, but declined by 6.4 percent. IBM came in second, at $12.75 billion in sales, but declined by a staggering 19.1 percent as the mainframe cycle hit its valley, Unix system sales continued to decline as it has with its peers, and the System x line sustained declines due to intense competition with HP and Dell and because of rumors that IBM wanted to sell off the System x division to Lenovo all through 2013. (That deal was announced in January of this year, and has yet to be completed.) Dell grew its worldwide server sales by 2.7 percent last year, hitting $8.28 billion, but its sales were decelerating as the year came to a close. Oracle declined 12.4 percent to $2.33 billion, and Cisco rose by 38.7 percent to $2.32 billion. Cisco has already passed Oracle to gain the number four slot in the vendor rankings, and unless something radical happens Cisco will probably hold onto that position for the foreseeable future. (Considering how many ex-Sun people work in Cisco's server business, there is a certain symmetry to this.)

Looking ahead to 2014, Scaramella says expect more of the same. "Mainframes and Unix systems are in the valleys of their cycles right now," he says. "In the wake of the Great Recession, there was a spike of system sales in 2010, and those machines are now going to be four years old, so we could see the start of a refresh cycle for X86 platforms in the enterprise towards the end of the year. But it won't be dramatically significant. Units are going to be modestly up again, following GDP, and I think revenue is going to move sideways because of all the market transitions. One segment goes up and another goes down."