Servers Slow And Switches Stall At Cisco

Every innovative product finds its natural place in the market, and that seems to have happened with the Unified Computing System, a converged server-network platform that Cisco Systems launched five years ago, reshaping the enterprise server and networking landscape.

UCS sales ramped fast out of the gate, and Cisco quickly became a player in blade servers aimed at enterprise customers. Cisco entered the server business, and its peers had to counter with their own expansion into networking and, in some cases, launching converged systems of their own. Even though Cisco is still growing faster than most of its tier one peers in the system space, its sales growth rate fell considerably in its most recent quarter.

In the quarter ended in December, which is the second quarter of Cisco's fiscal 2014, sales of datacenter products only grew by 10 percent to $605 million. Saying only is funny, because the systems market almost certainly grew at a much slower pace. (The market statistics will not be available from IDC and Gartner until later this month, so we are not sure yet.) The datacenter category at Cisco includes the UCS blade and rack servers as well as Nexus top of rack and end of row switches that are sold in conjunction with them.

On a conference call with Wall Street analysts, Cisco CEO John Chambers said that the company had a lower sales backlog coming into the quarter and then also had some issues with the timing of shipments, both of which put a damper on UCS revenues. Nonetheless, Chambers added that order growth was up in the middle 30 percent range and that the pipeline is strengthening.

"That momentum feels good," Chambers said. "We are very, very well positioned versus competition."

Cisco is still taking market share, Chambers said, and we will know for sure when the numbers come out in two weeks. Throughout the first three quarters of last year, Cisco had about a five percent share, by revenue, of the worldwide server market according to Gartner. The company's share of the blade server space is much higher, particularly in North America and especially among very large enterprises that have deployed virtualized workloads on thousands of server nodes in their IT shops. Cisco has well over 30,000 UCS customers at this point, and many of them come back for seconds and thirds after doing prototypes. Cisco has a small but growing presence in rack servers, which are necessary for data-intensive workloads like Hadoop. The company is focused on the enterprise, and doesn't chase deals among supercomputing centers or hyperscale datacenter operators. Those customers simply will not pay the premium that Cisco charges for servers and switches.

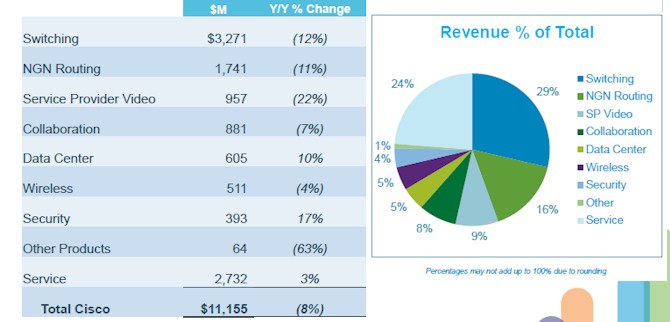

Cisco's switching business took a 12 percent hit in the quarter, dropping to $3.27 billion, and routing fell by 11 percent, to $1.74 billion. Cisco simply sold fewer boxes than it did last year, and Frank Calderone, the company's CFO, said that with a fixed cost base, the company's profits obviously could not hold. So on total sales of $11.16 billion, down 8 percent year-on-year, net income dropped by more than half to $1.43 billion.

Cutting into its profits during the quarter was another issue. If you read the fine print, Cisco had a charge of $655 million that hit in the quarter relating to the remediation of issues with memory components that were sold by Cisco between 2005 and 2010. Calderone said that this memory was made by a single supplier – which he did not identify – and had the potential to fail in the field; other vendors used the same memory during this time, he said. "Although the majority of these products are beyond Cisco's warranty terms and the failure rates are low, Cisco is working proactively with customers on mitigation," Calderone explained.