Amazon Web Services Outgrows And Dwarfs Cloud Rivals

Amazon Web Services had first-mover advantage when it launched its EC2 compute cloud back in March 2006, and that was by no means a guarantee of success. But incumbent hosting service providers and system resellers did not see the threat early enough and did not react fast enough. Try as they may, the many competitors that AWS now has cannot seem to catch up.

With hundreds of thousands of customers and untold numbers of systems (probably in the many hundreds of thousands) in its nine global datacenters, AWS doesn't just participate in the markets for raw infrastructure and platform cloud services. It utterly dominates its peers.

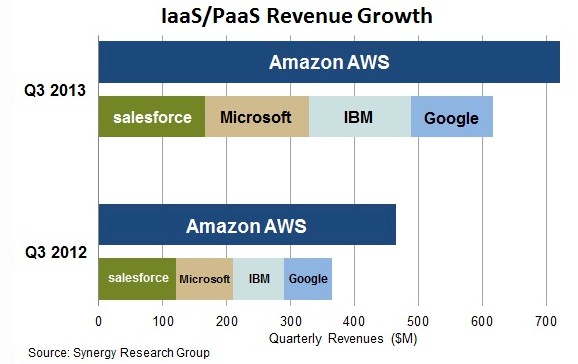

According to the latest market analysis from Synergy Research Group, which tracks the cloud market, AWS is considerably larger than its four largest rivals put together. And Amazon is growing faster than the market at large, too. Take a gander at this data from the third quarter ended in September:

The overall market for infrastructure and platform cloud services combined crested above $2.5 billion in the quarter, up a very sharp 46 percent from the year ago period. But AWS outgrew the market, rising 55 percent to $720 million in revenues across its infrastructure and cloud services. If you do the math, that means that all of the other vendors in the market that compete against AWS only grew by 43 percent, accounting for just under $1.8 billion in revenues in the third quarter.

There is plenty of growth to go around. IBM more than doubled its IaaS and PaaS cloud revenues to $160 million in the quarter thanks to its acquisition of SoftLayer last summer, and is neck-and-neck with Microsoft in terms of revenues. Microsoft, by the way, is growing nearly twice as fast as the market at large, with an 86 percent spike in the third quarter, and is rising even faster than the cloud subsidiary of retailing giant Amazon. Google's Compute Engine infrastructure and App Engine platform services together brought in around $130 million in sales in the third quarter, according to Synergy, rising 82 percent compared to the year-ago period. Salesforce.com has a slightly larger cloud business thanks to its platform cloud, with about $165 million in revenues, but it is only growing at 23 percent, half the pace of the market.

There are many other players in the infrastructure and platform cloud services space, lest you get the wrong impression from this chart above. They accounted for just under $1.2 billion in revenues and experienced an aggregate growth rate of 33 percent in the quarter. Each geographic region has its own big players, which mirrors the distribution of service providers and telecom carriers (and not coincidentally, since many of those firms are cloud players in their own regions).

"While Amazon dwarfs all competition, the race is on to see if any of the big four followers can distance themselves from their peers," said John Dinsdale, general manager at Synergy, in a statement accompanying the figures. "The good news for these companies and for the long tail of operators with relatively small cloud infrastructure service operations is that IaaS/PaaS will be growing strongly long into the future, providing plenty of opportunity for robust revenue growth."

Amazon invests more heavily than most of its peers in both hardware and software with the AWS service, which gives it tremendous scale and leverage. But that is not the only smart bit about AWS. By leveraging its skill as the world's largest online retailer to build an increasingly sophisticated set of cloud services that others can use, AWS could help Amazon recover some of its own IT investment costs. Moreover, the services available on AWS are now broad and deep enough, and as is the AWS customer set, that AWS is no doubt teaching Amazon's internal IT department a few new tricks. By offering a slice of its own IT operations for sale as a cloud seven years ago, Amazon not only came up with a new thing to sell, but also set up a feedback loop that will allow it to continually improve its own IT operations as it does so for other customers on its cloud.

The upshot is that if AWS never makes a nickel in profit, Amazon will still be the better for it. Not that Amazon seems all that concerned about bringing money to the bottom line – and this is what has each and every player in the infrastructure and platform cloud services business a bit frazzled, particularly those that are public companies. Amazon's competitors have to make money selling infrastructure services, just as they had to make money selling systems or software in days gone by. Amazon seems to be able to not make money and still be one of the darlings of Wall Street because its shares keep going up and up.